Hire comes amid growing demand in the segment

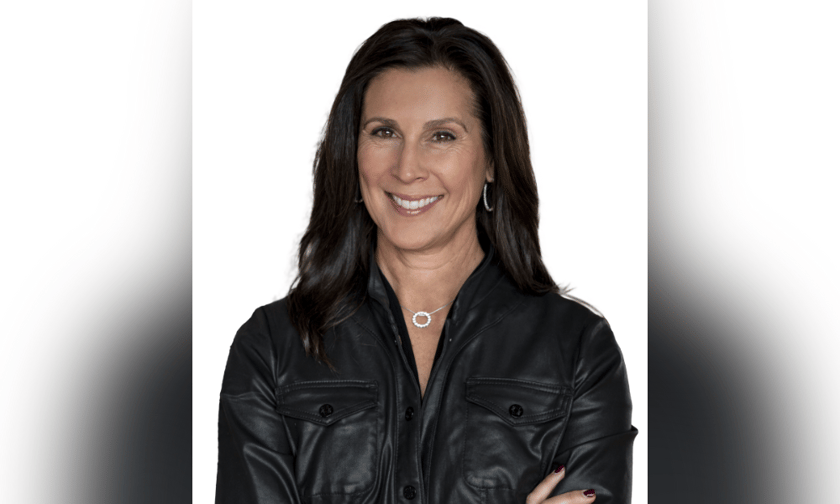

Onda, a managing general agency specialising in cyber insurance at Lloyd’s, has announced the appointment of Patrick Cannon, FCII (pictured above) as its chief claims officer.

Cannon brings extensive experience in developing and leading claims functions within the cyber insurance sector, including claims advocacy, claims preparation, and incident management. His career spans significant roles across various organizations.

He has served as the head of cyber claims at Marsh from November 2021 and previously held positions at Tokio Marine Kiln, including head of enterprise risk and casualty claims from July 2020 to October 2021.

Additionally, Cannon was involved in handling a range of cyber-related claims as well as technology errors and omissions, and intellectual property cases at Tokio Marine Kiln and earlier at Brit Insurance.

His appointment aligns with Onda’s focus on bolstering its claims handling capabilities amid growing demands in the cyber insurance market.

“I’m delighted to be joining Onda at this important time for cyber insurance. Our industry has never been better placed to deal with the increasing technological disruption faced by businesses. I look forward to being part of this growing team and this exciting new product,” Cannon said.

Alex Jomaa, Onda’s Chief Underwriting Officer, also expressed his enthusiasm about Cannon’s appointment.

“We are committed to delivering an exceptional claims experience for our customers, so we’re delighted that Patrick is joining the Onda team,” Jomaa said. “Patrick’s deep experience will be invaluable in growing our offer and his expertise further entrenches Onda as the market of choice for cyber insurance.”

Onda’s focus on bolstering its claims proposition comes amid projected growth for the sector; a recent report from OAC revealed that cyber insurance’s global gross premium volume witnessed a yearly increase exceeding 20% from 2019 to 2021, with projections indicating a surge in demand over the coming decade.

What are your thoughts on this story? Please feel free to share your comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!

This page requires JavaScript