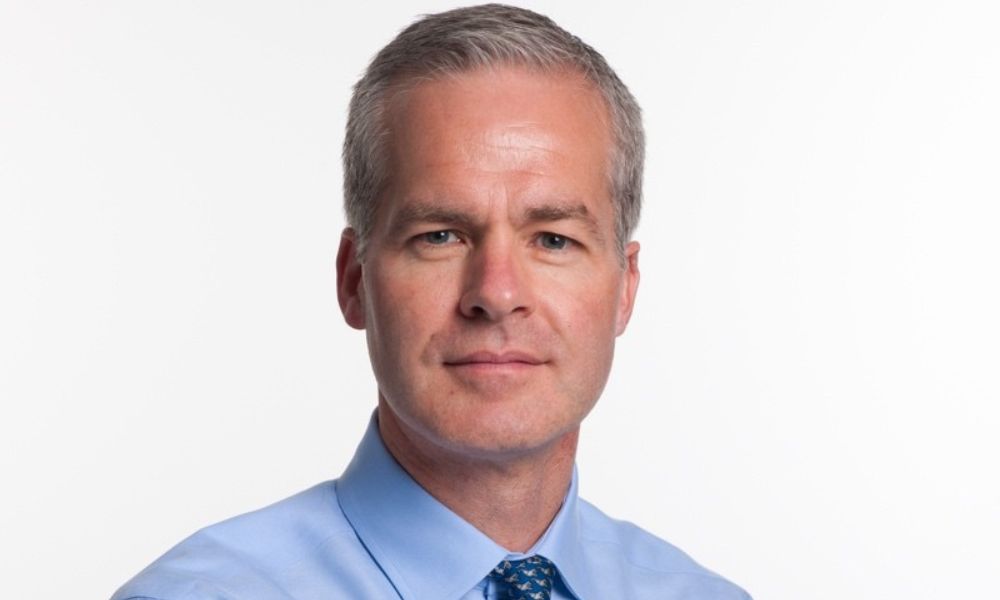

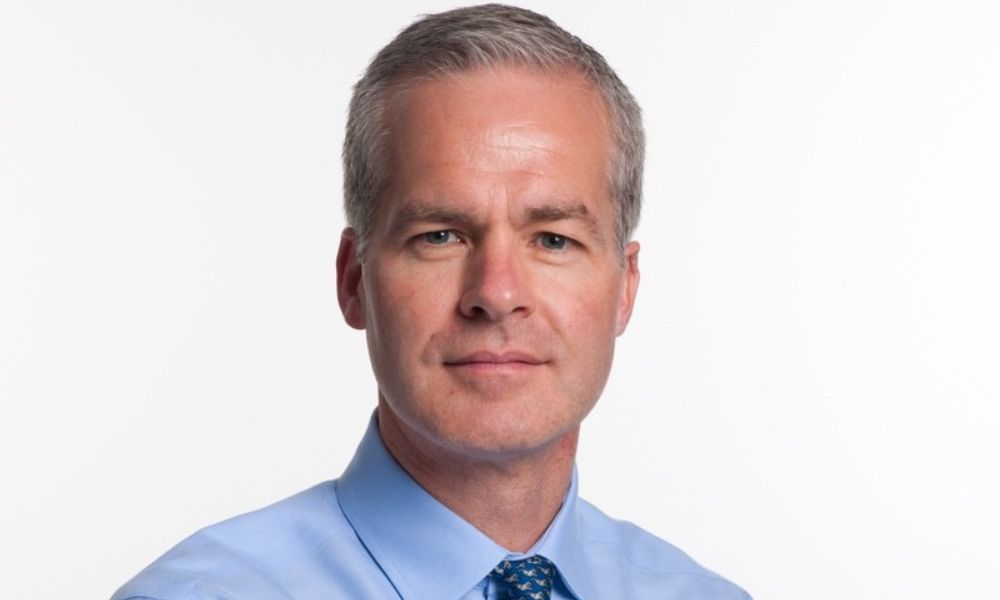

Commenting on his appointment, Burke said: “As a specialist insurer, HSB is uniquely placed to capitalise on the significant opportunities that exist by providing value-added expertise and knowledge to support our customers. I’ve been immediately struck by the passion HSB’s employees have for our business and their commitment to building on our success.”