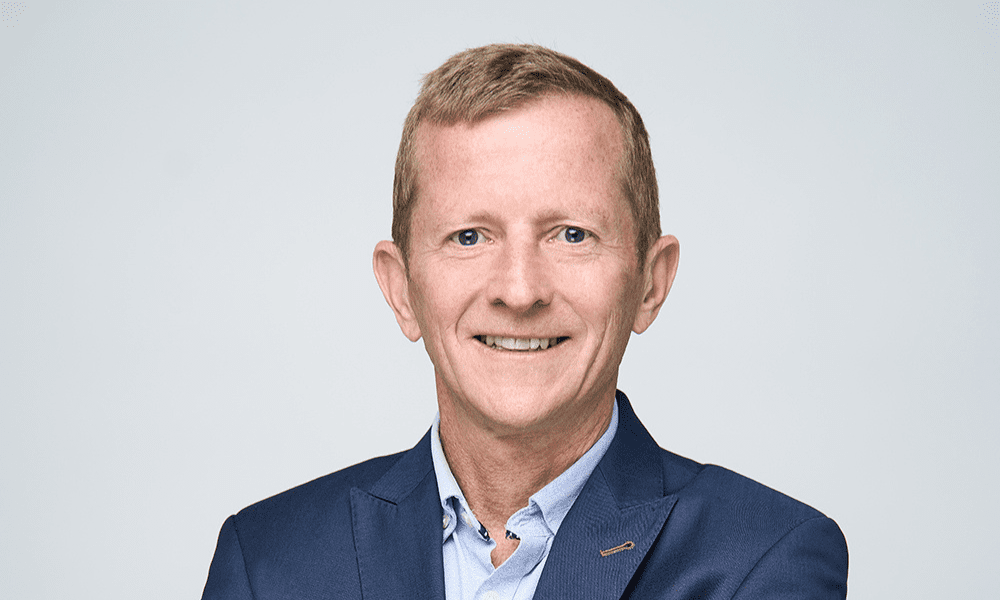

Oliver Slaney (pictured), operations manager and underwriter at Pulse Insurance, believes now is the time to give customers tailored insurance that meets their evolving expectations: “Customisation is key, customer appetites and expectations have changed with OnDemand TV, next day deliveries on packages – clients want the option to pick and choose add-ons and levels of cover depending on their needs for travel insurance, and insurers will need to adapt to be able to present offerings which meet these needs. There is a lot of competition in the travel insurance world, so being able to offer slightly nuanced benefits or perks is key, and customers want to feel that they are tailored to.”