Jump to winners | Jump to methodology

Generational superstars

Insurance Business has compiled the 2025 Global 100, featuring outstanding professionals from across six different markets: the US, Canada, Australia, New Zealand, Asia-Pacific and the UK.

All of those featured have had a definitive impact on the industry and taken their respective firms to new heights.

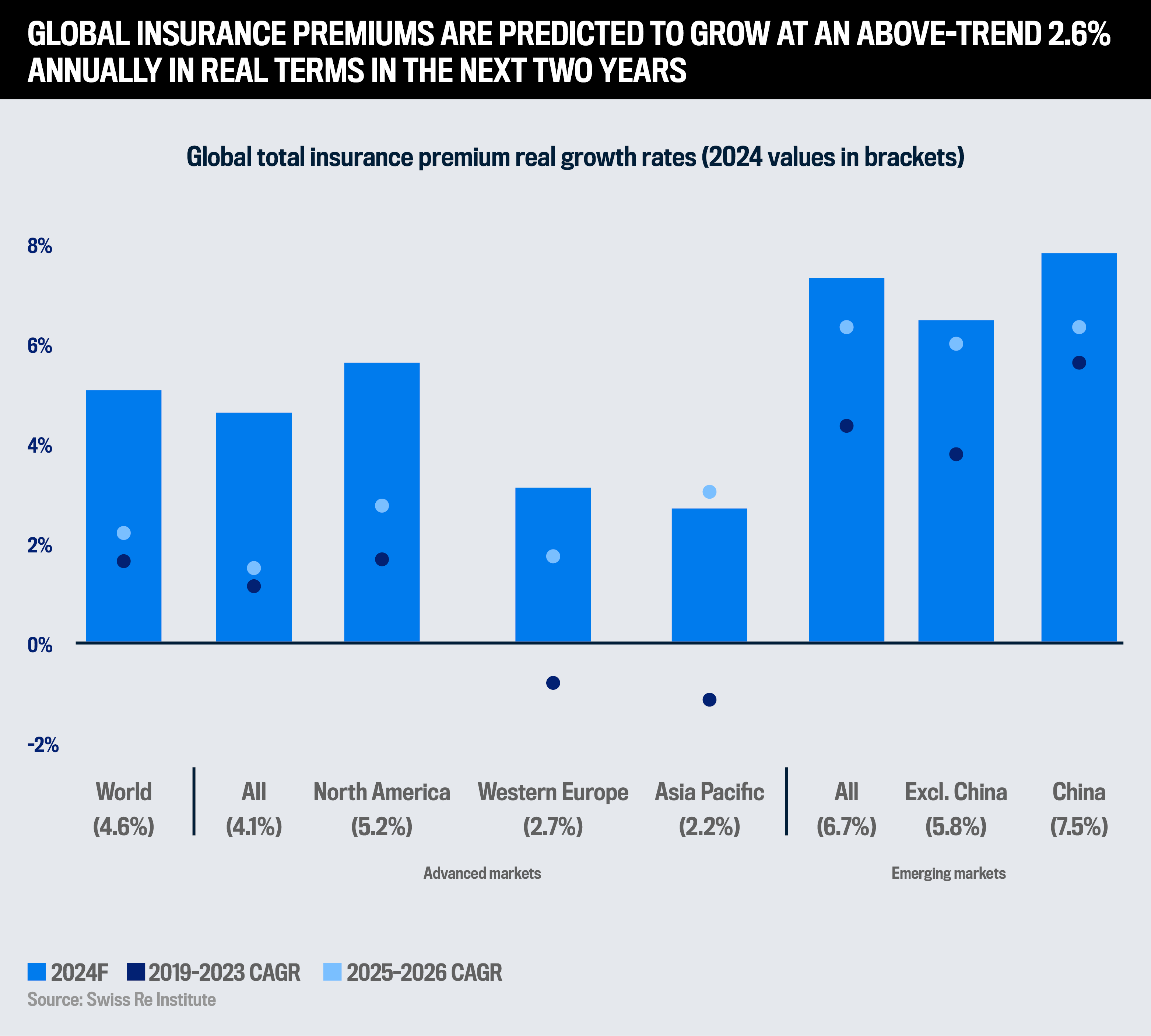

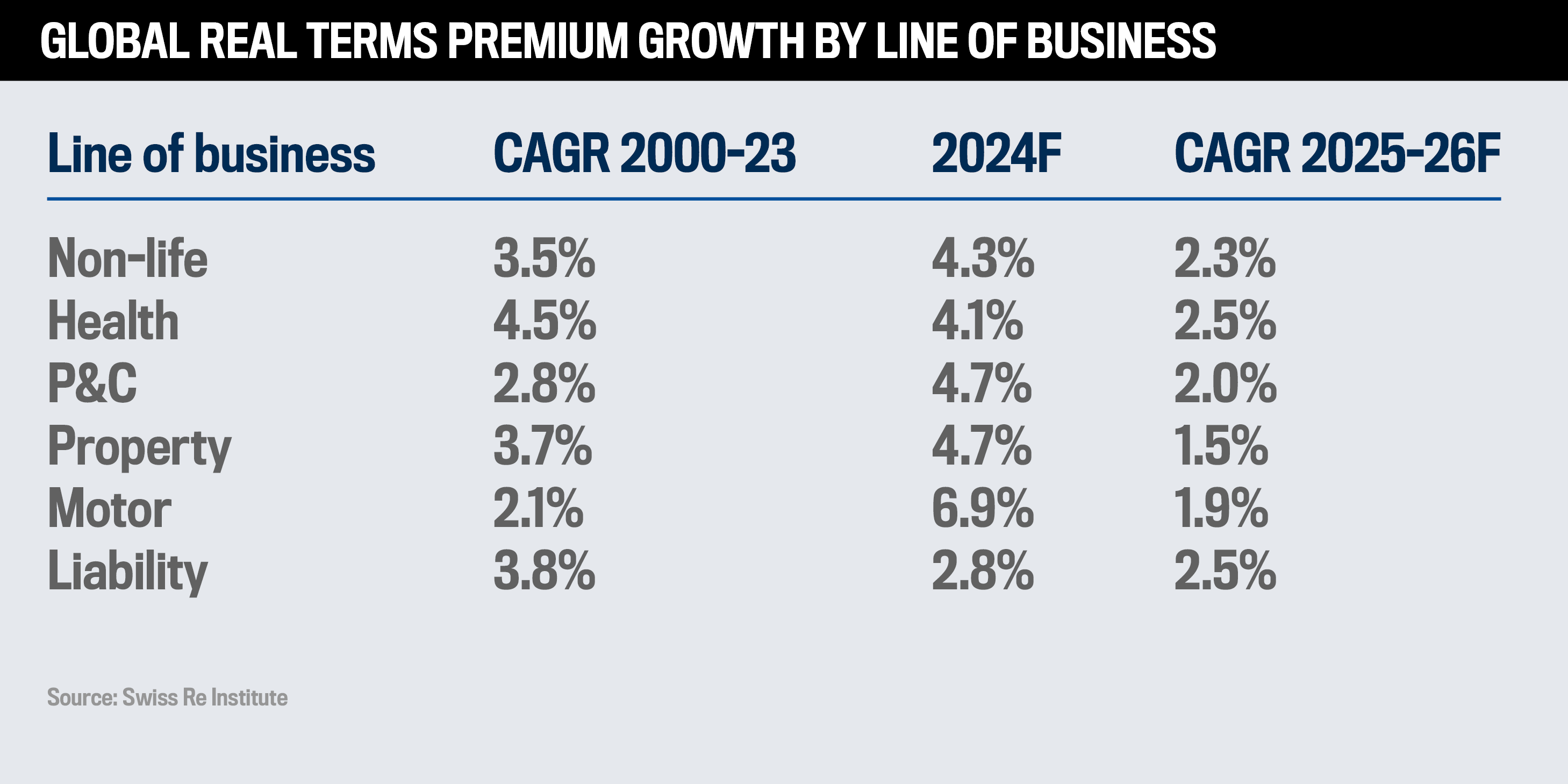

2024 sparked a recovery in global total insurance premiums, which rose by 4.6%, compared to the 1.6% average between 2019 and 2023.

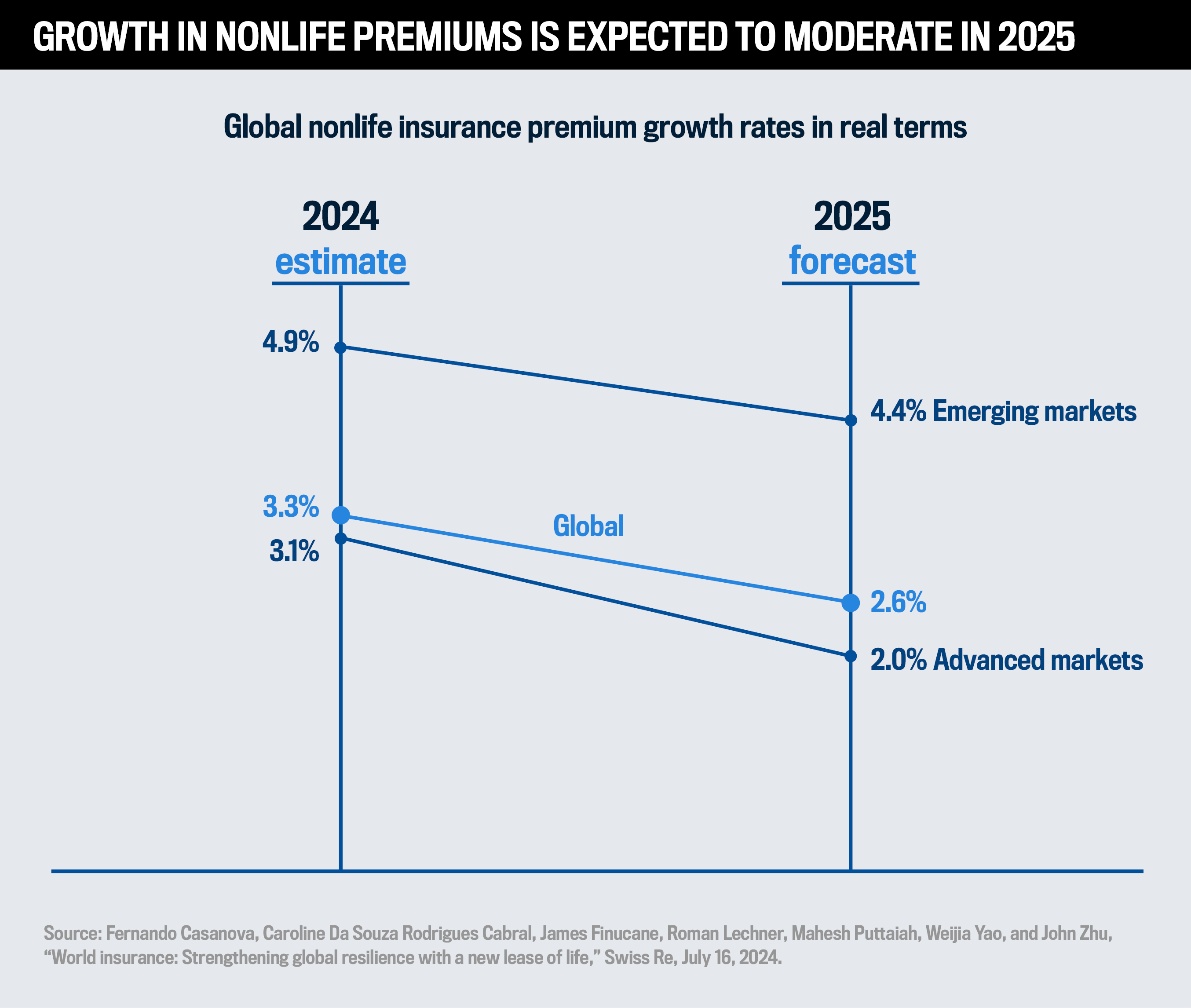

Swiss Re Institute expects growth “to be primarily driven by the life sector, although saving business growth will moderate as interest rates decline. Non-life insurance will grow more slowly than in recent years as the boost from the hard market tapers down. Life and non-life (including health) premiums accounted for 43% and 57% of total premium in 2024, and we expect this mix to stay largely the same over the next decade.”

Deloitte’s 2025 global insurance outlook states, “At a global level, estimates suggest that insurers’ return on equity could improve to about 10% in 2024 and 10.7% in 2025. Insurance premiums are estimated to grow by 3.3% in 2024, with advanced markets contributing 75% of the expansion in premium volumes.”

Global commercial insurance rates fell by 2% in the fourth quarter of 2024, marking the second consecutive quarterly decline after seven years of rate increases, according to the Global Insurance Market Index released by global brokerage Marsh.

Marsh attributed the decline to increasing competition in the commercial property insurance market, stabilisation in financial lines, moderation of casualty rate increases, and further reductions in cyber insurance pricing. The trend first emerged in the first quarter of 2021 and has continued to shape global insurance pricing.

Regional trends varied, with the Pacific region experiencing the largest year-on-year composite rate decrease of 8% in the fourth quarter. The UK saw a 5% decline, while rates in Asia fell by 3%, and both Europe and Canada recorded a 2% decrease.

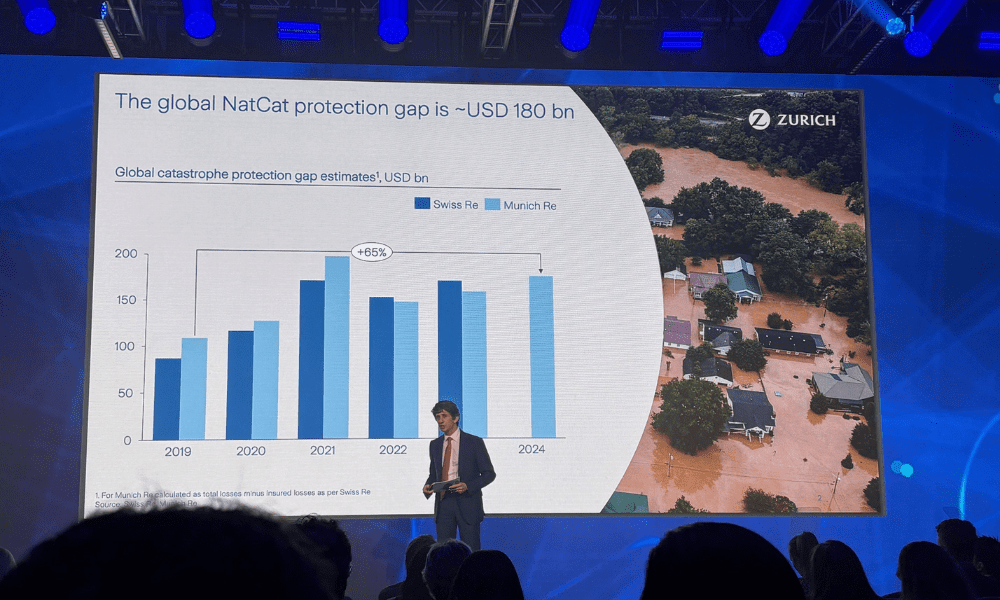

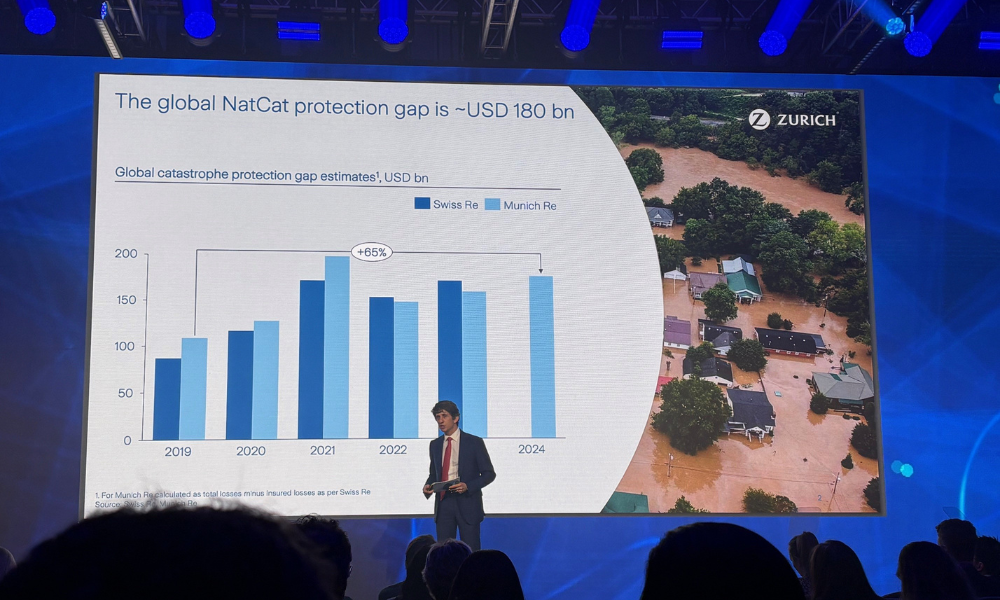

In addition, the insurance protection gap for natural catastrophes is estimated to reach 60% as 2024 becomes the first year to surpass 1.5° Celsius, according to WTW’s Natural Catastrophe Review for the second half of 2024.

Natural catastrophes continued to place significant pressure on global insurance markets in 2024, with global insured losses exceeding US$140 billion, marking the fifth consecutive year that insured damages topped US$100 billion. Total economic damages from these events exceeded US$350 billion, underscoring the lack of resilience to climate-related risks.

Insurance Business spoke to five members of the prestigious Global 100 to gain an insight into their roles and the impact they’ve made on the worldwide insurance industry.

Claire Burke is a true specialist who deals with the most complex apartment buildings with defects across Australia. Her skills stand out in a market where the availability of insurance is very small.

“As the market leader, we want to be able to provide support where we can. It’s legislated here to have insurance for strata buildings in place at all times, so there’s a big need to be able to provide this support. I’m in a really great position where I am empowered to find solutions,” she says.

Burke has built up her knowledge over the past 13 years since joining CHU without any knowledge of the strata sector. Stints as an underwriting manager enabled her to hone her technical skills as colleagues escalated matters regarding defects.

What marks Burke out is that she rarely declines a risk.

She says, “It’s something we do minimal of because our goal is to provide a solution where possible and where it’s come to a point where we have declined, we take our time to explain it to the broker so they can share it with the insured.”

“I’m very proud to be recognised. I hope to show other women, especially queer women, that you can be a leader in this space”

Claire BurkeCHU Underwriting Agencies

CHU and Burke are open to reviewing the case if new details are provided and remedial work is carried out or scheduled.

“It has happened a number of times over the last 12 months, where we’ve declined and overturned that once we’ve been provided sufficient information,” says Burke. “We have to protect our insurer, QBE, but we are also in this business for our clients. It’s a balancing act.”

As a renowned subject matter expert, Burke educates not only colleagues but the wider industry. Her webinars on building defects in strata have received thousands of viewers online.

“Education is such a huge part of what we can provide, and I am really passionate about educating our underwriters in this space and our clients, brokers and the strata managers we deal with,” she says.

In 2025, Burke plans to step up her education efforts.

“I don’t have any issue with sharing my knowledge,” she explains. “I love one-on-one training at work, sitting with an underwriter and working through an account, so they can understand the decisions I’m making.”

Another side to Burke’s advocacy is supporting and encouraging the LGBTQIA community within the insurance industry by posting on CHU’s intranet around celebrations and events to raise awareness. She encourages anyone to come to her with concerns.

“They can come talk to me if they are struggling with anything or people within the business might see my posts and then spread that out into the broader community,” she says.

Leading by example is a matter of pride for Burke.

“I want to be a voice for people where they might not feel they can be a voice or have a voice.”

Jodie Kaufman Davis – H.W. Kaufman Group

Co-president

In October 2024, Jodie Kaufman Davis took on the role of co-president and is focused on H.W. Kaufman Group’s network of companies outside of North America, as the group has over 60 offices worldwide.

Her work involves bringing the global executive team together in London for a summit.

She says, “We have tremendous opportunity to really look at the portfolio that we have around the world and figure out how we can do more together. Any one of our parts independently that’s stronger will positively impact the other parts.”

H.W. Kaufman is a third-generation family-owned and operated business, where father Alan is chairman and CEO. Other members of the executive team are from outside the family, but they form a strong collective.

Kaufman Davis says, “The opportunity to spend time together, both formally at meetings and informally at social events, really makes a positive impact. The more time we can spend together is better for our business and that value has been ringing true at Kaufman for 55 years.”

Because communication and relationship building are vital to the firm, she focuses on strengthening links.

“I’m really looking forward to building out our talent, technology and infrastructure, and strengthening our international operations, so that our North American business can better utilize and access our international businesses,” she says.

Challenging the status quo is the norm for Kaufman Davis. She seeks out opportunities and looks to leverage where possible to drive the firm forward.

“We operate an open-door business; anyone can call me and I meet our interns regularly throughout the summer. I spend a lot of time building relationships at all levels to keep my fingers on the pulse and understand what’s happening”

Jodie Kaufman DavisH.W. Kaufman Group

“My father has been a true visionary in the industry and creating this global platform and it’s for a reason, it’s meant to be connected, “she explains. “I’m always thinking about how I can bring more people together and better connect teams. It’s all ultimately to produce better results both for our organization and clients.”

Previously an M&A lawyer, Kaufman Davis made the shift to insurance and encourages more to follow in her footsteps due to the diversity and options across the industry.

Part of these efforts is mentoring younger professionals and enabling them to develop.

“I love to bring people into the fold and in our business. We have the Kaufman Institute, which is our training and development arm. I participate in creating some of the content and learn a lot from feedback,” she says.

Kaufman Davis relies on employee insight via surveys from the firm’s associates as well as an annual employee engagement survey.

“Through that, we’re able to see what opportunities individuals are excited about and different needs that our associates have. I welcome feedback. I go to a lot of our events and talk to people and hear from them.”

Kaufman is also a powerful champion of DEI across the company. This is partly driven by the insurance industry not having enough talent to meet demand. She supports being creative and attracting individuals from different groups.

“The more we get out there and the more diverse we are in our efforts and the bigger network we build, the better talent that we’re going to bring into the industry and into the organization,” she says. “It’s going to produce better results and more opportunities.”

And reacting to being part of the Global 100 in 2025, she adds, “I’m always honoured to be recognized by an industry that I love and for which I have great passion, which has provided me with tremendous opportunity and to which I intend to continue giving back.”

Operating at the industry’s leading edge, Honey Insurance is leveraging tech to redefine the customer experience. One of its solutions is smart home sensors.

“They notify homeowners about things that go wrong, for example it could be a leak whereas otherwise they wouldn’t even know about it,” explains Angelo Azar, chief operating officer. “It’s implicitly building on our engagement with them because they see Honey Insurance has notified them of something that could be going wrong in their home. That helps to build a relationship.”

The firm is now four years old but has managed to capture just over 1% of the market and over $165 million in GWP.

Azar says, “It’s still well shy of our ambitions to get to 5% market share and be in at least one in 20 Australian homes.”

The challenge for the COO is as Honey Insurance has grown its customer base, it has also increased the team. Instilling the same mindset and values are key to Azar in maintaining the firm’s customer-first mindset and focus on making interactions more efficient.

“When you’re 10 people, you’re wedded to the plan and it feels like a startup, but we are about 170 now. It’s about ensuring as an executive team, we continue to have the speed of a startup, but the rigour of a mature organization and what I mean is that as you grow you need to be less prone to mistakes, but still have the ability to test, learn and fail quickly,” he says.

As part of this process of trial and error, there is a weekly Tuesday meeting where the executives present their key strategic priorities and any pivots.

“With AI, you can either choose to be friends with it or you can choose to be enemies, but I think the latter is to your own downfall”

Angelo AzarHoney Insurance

Due to the focus on growing and refining their process, Honey Insurance doesn’t get distracted.

“If you’re looking sideways, then you’re not looking ahead. We can either waste time looking left and right or focus on what initiatives and benefits we can bring to the Australian community and our customers,” says Azar.

Honey Insurance has adopted AI to improve their effectiveness and are working on a program involving it around digitization. The idea is when customers engage with the firm, it’s a seamless and pleasant experience.

He says, “Sometimes, you engage with organizations and it’s quite awkward because of the time spent trying to work out who you are and all that sort of stuff. We want to be able to make it so that you’re readily identified and use AI-supported tools to be able to better respond to queries. It makes for a more fluid and dynamic conversation.”

Improving and learning is very much the company’s internal ethos.

“It’s not about spraying the gun everywhere and hoping something sticks. We want to be able to use data to make the customer experience better and improve risk selection,” Azar says.

Honey Insurance’s blueprint requires discipline over motivation to maintain its growth trajectory.

“It’s not just about motivation as sometimes people fall into that trap, which means you sometimes switch off. Discipline means you know what the goal is, and you pursue the goal irrespective of what’s thrown your way,” Azar explains.

This is underlined by his drive to keep on succeeding.

“It’s not about saying we’re doing great and stopping. It’s about how many more customers we can help and bring into our environment.”

As part of one of the largest wholesale intermediaries in the United States, Ben Beazley has dealt adeptly with changing circumstances – the switch from one of the hardest markets in years followed by the 2024 correction – due to his passion for the industry.

“The market is a transition market where underwriting companies are choosing to do different things with different appetites as they realize there’s money to be made, and there probably is more money to be made today than there has been in 20 years,” says the veteran professional.

The influx of capital requires innovative ideas, which Beazley can provide due to his experience. He says, “It requires people to think outside the box and to be turning over every stone for the insured. It’s a challenging time to make sure you’re doing the best job for the insurer.”

One factor in why this type of thinking is required is the higher occurrence of climate events, which over the past year included Hurricane Helene, snowfall in New Orleans, and the California wildfires.

Beazley comments, “It’s a really interesting time in the industry and nothing that I have ever experienced in my 40 years up until this point.”

“Finding solutions to an account that otherwise seems very daunting is what puts me on a high, quite frankly”

Ben BeazleyJencap Group

Part of his role has been to support and lead more junior colleagues through the changing market. Young brokers had been used to an uptick pricing and rise in commissions.

“In a soft market, you’ve got to get way out ahead of the accounts and tell your clients there’s a lot of options on the table,” says Beazley. “There is a lot more mentoring that needs to go on, and that is something which the industry has got away from over the last 10 years or so.”

Jencap’s new office has helped, as staff is choosing to work more from the office, which allows him to be in direct contact to share knowledge. Beazley’s mentoring style is about challenging the individual to volunteer a solution or strategy for an account and then suggesting other ways that they might look at it.

He adds, “I definitely introduce them to different markets and relationships that I’ve developed over the years, as this is very much now a global insurance marketplace with London, Bermuda, and there’s capital coming out of places like the Middle East and other places in the world, too.”

Driving Jencap’s property department forward is Beazley’s remit. He’s doing it successfully but feels there is more to come.

“I got a couple of large clients and want to see them continue to grow, but there is a lot of capacity, a lot of opportunity, and I’m looking to take advantage of that.”

And he continues, “Jencap is an emerging wholesale broker and we’ve got a lot of runway, I call us ‘brokers without borders’ because we have a fairly small production team on the property side and a tremendous amount of opportunity for people to further their career. The highest points of my career have always been seeing young people attain goals that they might have otherwise thought were unattainable and meeting the goals they’ve set for themselves.”

Running a global claims management firm with over 9,000 employees in 70 countries has been a true test of leadership over the last year due to cyclones in Australia, massive flooding in Europe and Canada, storms in the UK, along with a series of climate catastrophes in America.

“I think we as an organization have done extremely well in really delivering on our mission and purpose which is to restore lives, businesses and communities,” says Rohit Verma. “We did extremely well to be there for our customers and clients.”

Operational excellence is a priority for Verma and something he wants to continue developing in 2025.

“We started a journey of operational excellence as we believe that because of our global nature, it’s really important to be best in class,” he says.

Empathy is the trait that Verma disseminates across his team and staff, with the standpoint that clients will get in touch on what is one of the worst days of their lives.

“They could have lost their home or a vehicle that is pretty important for their livelihood and family. God forbid they got injured or have lost a family member,” comments Verma. “They hope that we can bring some level of normalcy back to their life. It’s really important to understand that it’s not just a claim – it’s a life, a business, a person, a family. Frankly, that’s the biggest driver for me and the team.”

“We will continue to deliver for policyholders and claimants because at the end of the day, insurance is the engine that runs the economy, that allows people to take risks and push the envelope”

Rohit VermaCrawford & Company

AI is at the forefront of Verma’s thoughts, like his fellow CEOs across the industry. He has introduced it at Crawford but is cautious.

“We have an offering for the market, which is SaaS-based using AI, and we have a council within our business looking at different AI use cases and prioritising those, so we’re definitely on it. I would say that we’re in the early stages as opposed to where we are using it in our daily work,” he says.

Even as more tech and AI enters processes, Verma is committed to maintaining the empathy and understanding that has enabled Crawford to be successful.

He explains, “I’ve had this contrarian view that even when the discussion was that AI is going to eliminate the role of the loss adjuster, I just don’t think that’s the case. Empathy or ‘the human in the loop,’ as it is called now, is going to remain extremely critical. We are looking at what kind of things AI can do that support the adjuster.”

Sitting at the top of the firm, Verma is aware enough to measure his own performance.

He does this in relation to four stakeholders:

“I try my best to do what I can across all four. The pulse survey is a way to know if employees are feeling challenged, developed, and satisfied. It’s also important our brand is talked about in a way that it’s something the community feels if it wasn’t there, that they would be missing something important,” he says.

- Ajay Mistry

Gambit Partners and iCAN - Amanda Whiting

Insurance Council of New Zealand (ICNZ) - Andreas Berger

Swiss Re - Andrew Hall

Insurance Council of Australia - Anne Marie Elder

AXA XL - Chris Walters

Inszone Insurance Services - Colette Taylor

Sovereign Insurance - Collin Yap

Specialist Risk Group - Damien Coates

DUAL Asia-Pacific - David Clare

Trisura Group - David Heathfield

AssuredPartners UK and Ireland - David Morrow

Chubb New Zealand - Dawn Miller

Lloyd’s Americas - Despina Buganski

WTW - Dhara Patel

Davies - Dionne Bowers

Canadian Association of Black Insurance Professionals - Duane Hercules

Safety National - Echaunti Swan

iCAN - Edmund Reese

Aon - Fiona Hayes-St Clair

QBE - Graeme Trudgill

British Insurance Brokers’ Association - Greg Smith

Crawford & Company Canada - Greg Zimmer

Alliant Insurance Services - Guy Cormier

Desjardins - Ilan Serman

Gallagher - Jack Kudale

Cowbell - Jane Kielty

Aon - Jason Storah

Aviva - Jenny Bax

Underwriting Agencies Council - Jerald Tillman

NAAIA - Jeremy Lau

QBE Asia - Jim Blue

Alera Group - Jimmy Higgins

Suncorp New Zealand and ICNZ - Jodie Kaufman Davis

H. W. Kaufman - Jo Sykes

Markel - Justin Delaney

Zurich Australia and New Zealand - Kate Della Morra

CFC Canada - Katrina Shanks

ANZIIF - Ken Norgrove

RSA Insurance and Association of British Insurers - Ken Reigler

At-Bay Insurance - Kenneth Reilly

Sompo Asia Pacific - Kent Chaplin

Delta - Kevin Doyle

Risk Placement Services - Kristen Valder

Arch Insurance International - Kristin H. Martin

Utica Insurance - Mandy Young

NSW State Insurance Regulatory Authority - Marie Eve Paquette

APRIL Canada - Mark Lange

Allianz - Mary Boyd

Hiscox - MaryKate Townsend

Lloyd’s - Matthew Hill

Chartered Insurance Institute - Matthew Wilson

Travelers Europe - Michael Ferber

Victor Insurance Managers - Mike Arbour

Sedgwick - Mike Bruce

Brown & Brown Europe - Mike Hessling

Gallagher Bassett - Mike Palotay

Tokio Marine HCC Cyber & Professional Lines Group - Natasha Gale

ARAG Australia - Neil Kessler

CRC Group - Nick Creatura

CNA Canada - Nigel Fitzgerald

Steadfast - Patrick Hennessy

Marsh - Philip Hobbs

Liberty International - Philippe Meyenhofer

PartnerRe - Ram Kangatharan

Auto & General - Rebekah Clement

Lloyd’s - Richard Klipin

National Insurance Brokers’ Association - Richard Milner

Chaucer - Roy Gori

Manulife - Sabrina Hart

Munich Re Specialty - Sam White

Stella Insurance - Sara Mitchell

AXIS Capital - Sarah Stanford

Aspen UK - Sare Ozkara

Vero - Satpreet Chandra

Marsh NZ - Scott Reichelt

Crawford - Shawn DeSantis

Navacord - Simone Labady

Aioi Nissay Dowa Management

New Zealand and ICNZ - Sonia Caamano

Howden - Soon Keen Lee

Canopius - Stephanie Ogden

HDI UK and Ireland - Susan Johnson

The Hartford and NAAIA - Takuya Aibe

Howden Japan - Tara Foley

AXA UK and Ireland - Taylor Rhodes

Applied Systems - Thomas Lillelund

Allianz Commercial - Tim Ryan

Lockton - Timothy Sweeney

Liberty Mutual - Timothy Turner

Ryan Specialty - Tony Wheatley

Berkley Insurance Australia - Traci Boland

IBAC Ontario West Insurance Brokers - Tracy Garrad

Aviva Canada - Vishal Kundi

BOXX Insurance