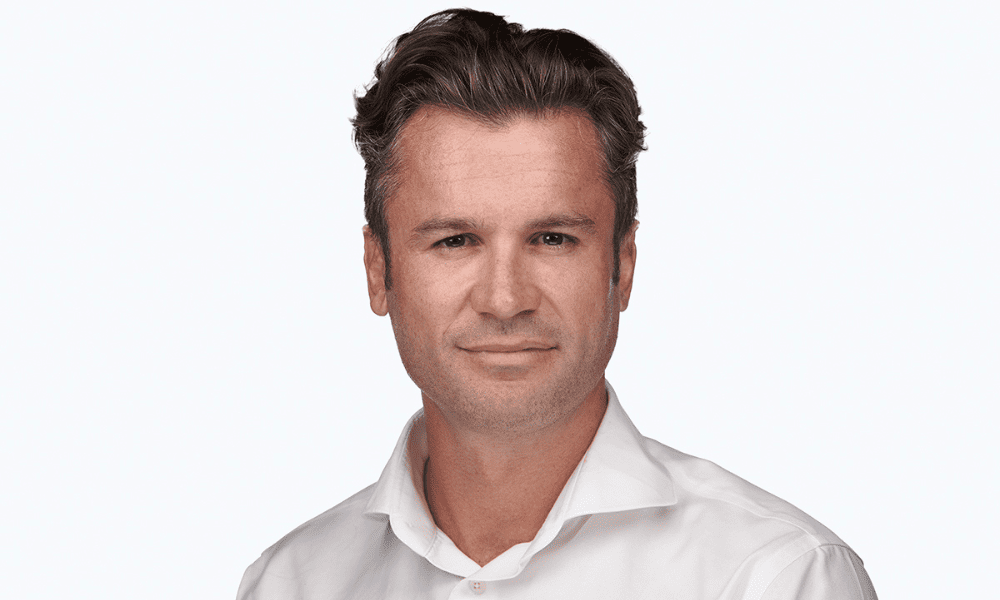

“WTW delivered a strong second quarter, generating significant EPS growth and margin expansion through robust organic growth, operating efficiency, and the continued execution of our transformation program,” said Carl Hess, CEO of WTW, in an earlier statement on the company’s long-term financial strategy.