![]()

Jump to winners | Jump to methodology

Staking their claim

Record-breaking payouts and intensifying weather-related events shone a spotlight on the UK’s top insurance claims insurers’ crucial role in supporting their customers during difficult times.

According to December 2024 data from the Association of British Insurers (ABI), who represent over 300 firms and 300,000 professionals within the UK’s insurance and long-term savings sectors, property payouts hit a record high during the second quarter of the year, with insurers paying out £1.4 billion in claims to help homeowners and businesses cope with events such as fire and flooding.

ABI’s latest claims data also shows:

-

Claims for damage to homes from storms, heavy rain and frozen pipes reached £144 million in the second quarter of 2024. This is the fifth consecutive quarter where weather-related claims have exceeded £100 million.

-

Weather wasn’t just a problem for homeowners. Claims for weather damage to businesses remained high at £81 million.

-

Subsidence payouts for home insurance claims were also up in the second quarter of the year, hitting £60 million, the highest quarterly figure on record and up 12 percent on the £53 million paid in the first quarter of 2024.

Claims and costs continue to impact premiums in the same period:

-

average price of home insurance rose to £396, up £21 (6 percent) on the previous quarter

-

average buildings-only policy was £321, an increase of £23 (7 percent) from the previous quarter

-

for contents-only cover, the average price paid was £137– £5 (4 percent) higher than in the first quarter of 2024

-

average premium for a combined policy increased 19 percent compared to the same period in 2023

Louise Clark, policy adviser at the ABI, says, “Home insurance plays a vital role in supporting customers when the worst happens. Despite rising cost pressures, insurers remain committed to offering competitively priced cover and helping their customers during a claim.”

She adds, “Our latest figures demonstrate the devastating impact that adverse weather can have on people and their homes. That’s why it’s important that the government takes the opportunity to reform the planning system and focus on prevention and resilience measures. Urgent action to tackle surface water flooding and maintain flood investments and maintenance will also help reduce the future impact of flooding.”

IBUK’s 5-Star insurance claims insurers exemplify the qualities that Gallagher Bassett claims experts have described as essential in standing out as industry leaders:

-

expertise and industry-specific knowledge

-

efficiency and streamlined processes

-

exceptional service to guide claimants while achieving the best possible outcomes

“A 5-Star claims provider can handle claims promptly and with technical accuracy, has a constant commitment to excellence and streamlining processes, and has the technological capabilities that allow their team to focus on future efficiencies,” Gallagher Bassett chief client officer Jenni Pendrey explains.

Gallagher chief operating officer John Fearn adds, “With increasing regulation, compliance, and case complexity, it’s also key that a claims provider can demonstrate how they are resourced to meet and exceed your expectations and achieve the best outcome possible, in respect of cost, service, and collate meaningful insights from a risk management perspective.”

The standard and performance of UK claims providers have historically been driven by those who invest in technology and develop their workforce, factors that underpin Gallagher’s repeated recognition as a top insurance claims carrier.

“However, both of these drivers must be backed by strategic investments in automation and talent development, which will deliver the most effective outcome for their clients,” Fearn explains.

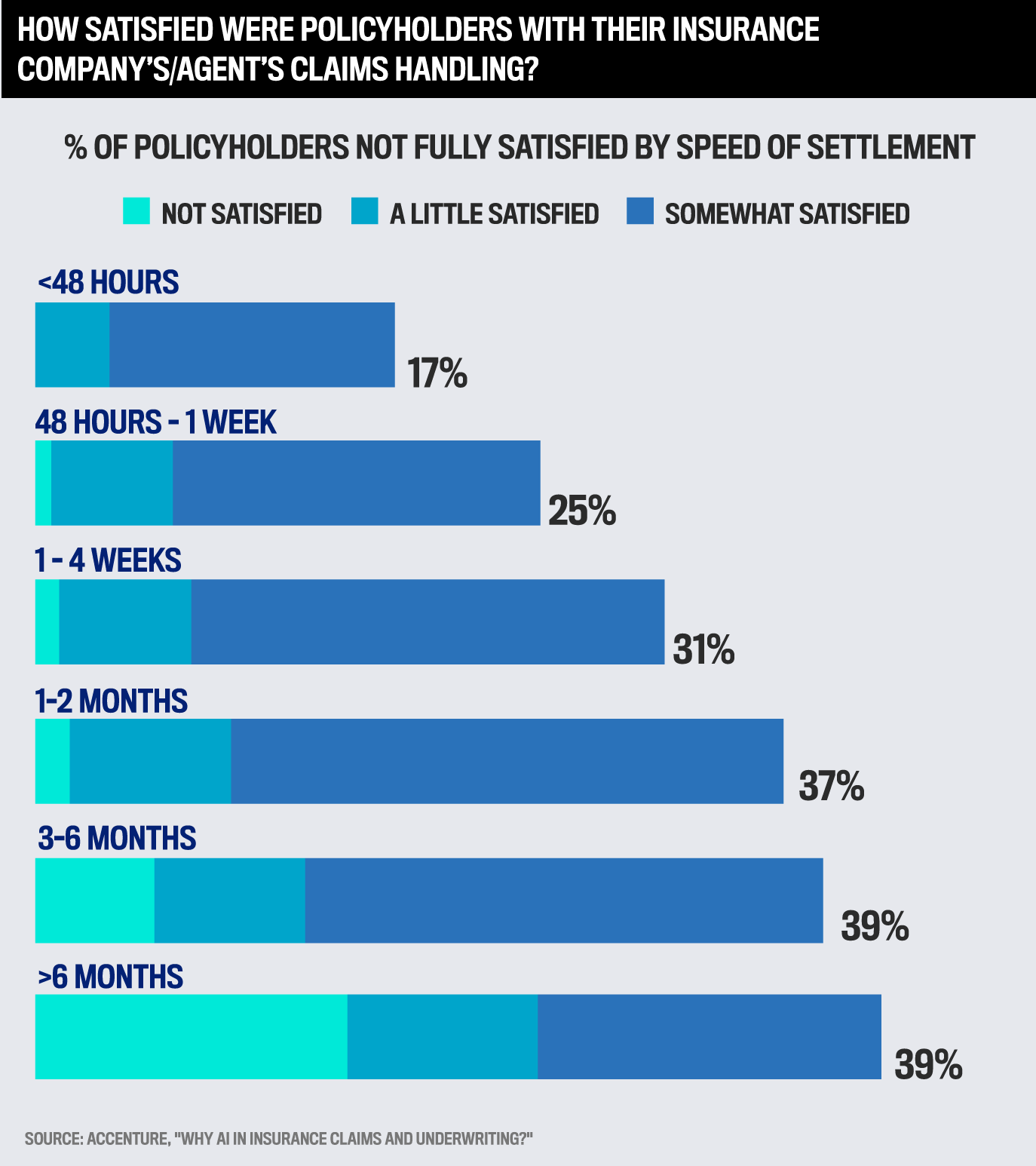

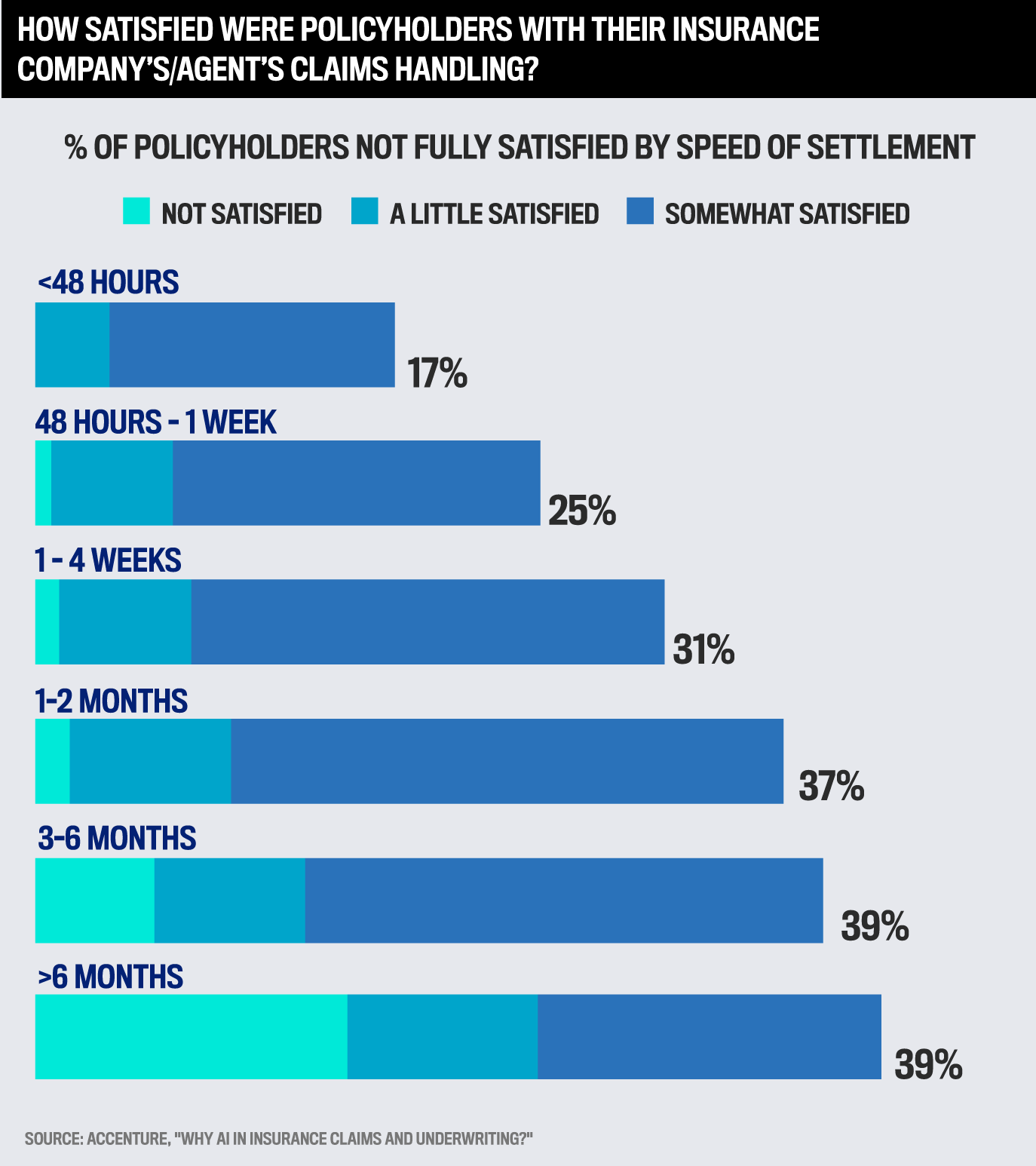

The importance of claims excellence to competitiveness is highlighted by recent Accenture research, which indicates that poor claims experiences could jeopardise up to $170 billion of global insurance premiums by 2027. Inefficient process and underwriting could potentially cost the industry another $160 billion over that same time.

Moreover, the report revealed that dissatisfaction with the claims experience is a crucial reason customers switch insurers:

Industry experts on client service and fast turnaround

A provider who can deliver exceptional client service is critical for insurers, risk managers, employers, and brokers, asserts Pendrey. She states a provider should:

-

act as an expert extension of the team

-

maintain clear and consistent communication

-

be responsive to inquiries and issues

-

adopt a proactive approach to managing opportunities as they arise

“As someone who has recently moved from the client side to working for my former employer’s claims management provider (Gallagher Bassett), I have seen the direct, positive impact a true commitment to client service can have on a company’s growth,” she reflects. “At the core of any claim is a person who wants transparency and clear, effective support to resolve their claim in the most appropriate and efficient manner possible.”

Fearn points out that Gallagher is heavily focused on the intake and triage process following an incident/claim notification. This process allows the team to identify potential mitigations proactively.

“We have found that this approach to the investigation and information-gathering process enables a swift settlement, where possible, and effective communication with our clients of any coverage or liability challenges,” he remarks.

With that in mind, Fearn emphasises the following factors for achieving outstanding claims processing times:

-

effectively manage claim complexity to mitigate costs and ensure the best possible outcomes

-

implement a straightforward, evidence-based triaging process for claims, setting realistic expectations and allocating sufficient resources to accelerate resolution when appropriate

Selecting the UK’s best claims insurers

IB’s research team surveyed brokerages and sourced feedback from hundreds of insurance brokers nationwide in the search for the best of the UK’s claims insurers. Respondents rated the claims insurers they had worked with over the past 12 months, enabling IB’s team to assign weighted values to each of the criteria rated by brokers. The insurers that received the highest rankings for work quality, specialist expertise, and client service were named 5-star award winners in claims insurance.

Almost half of respondents – 42 percent – identified themselves as claims handlers, with 27 percent working as brokers and 31 percent involved in areas such as counter fraud, underwriting, senior management, and business analysis.

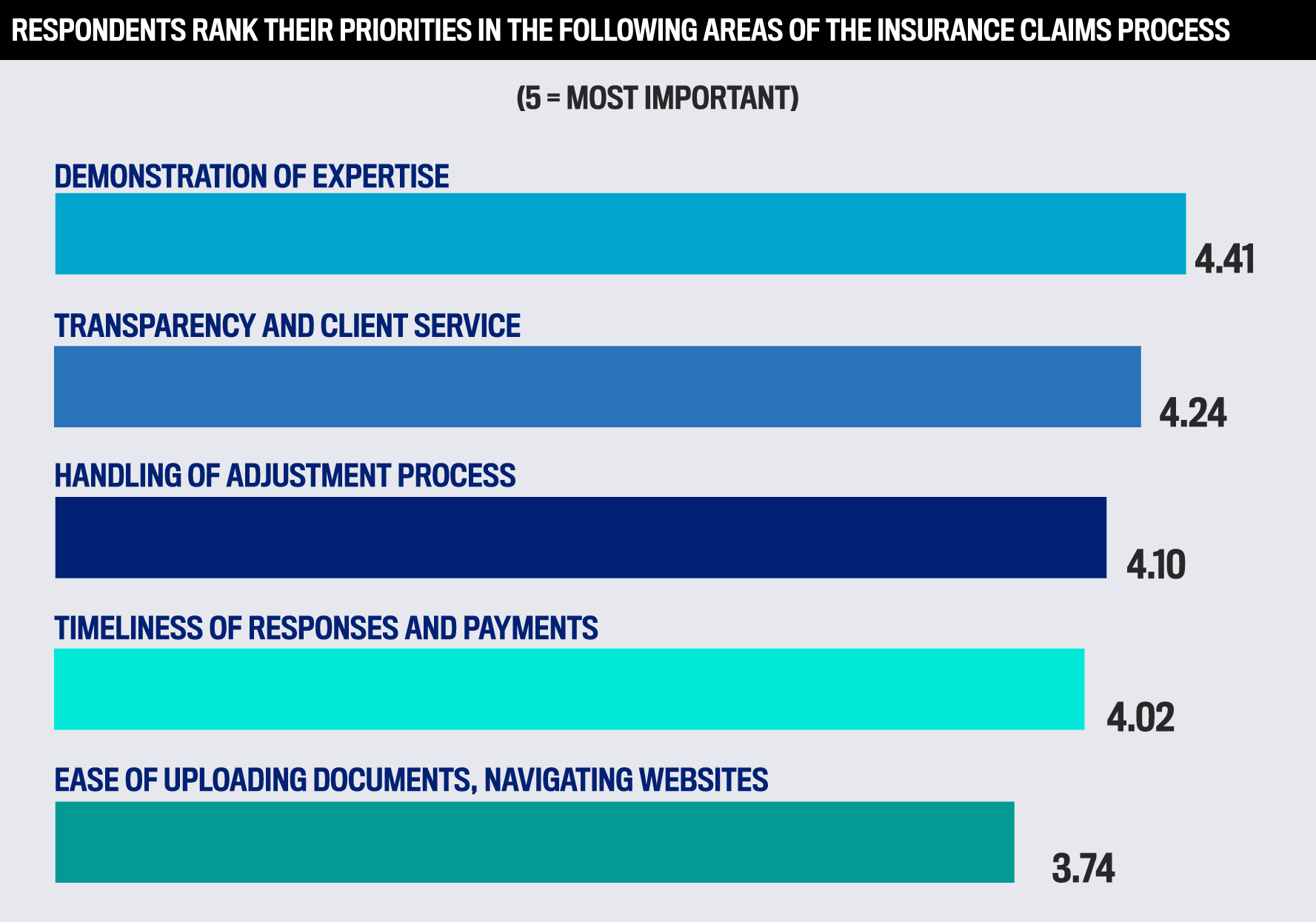

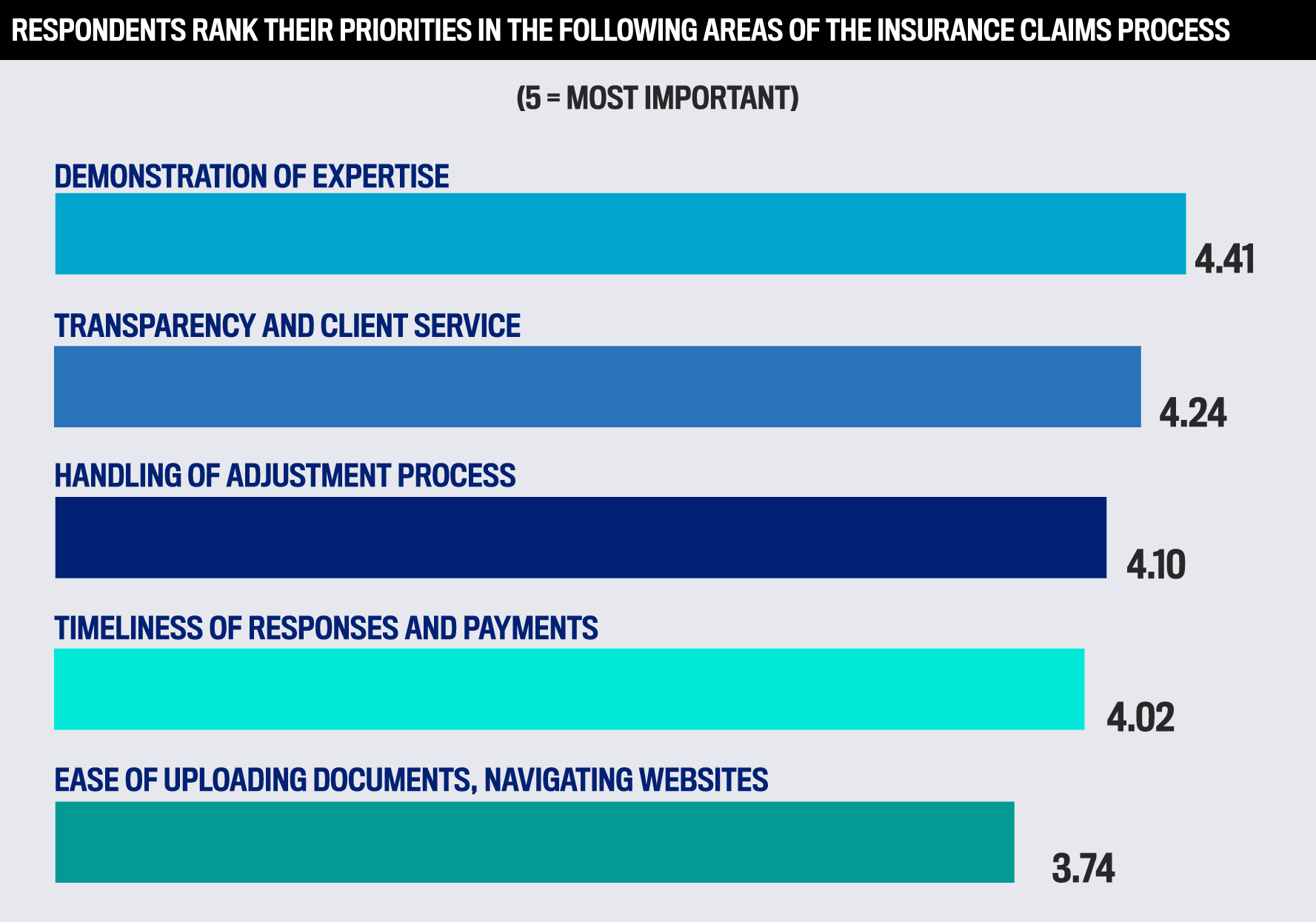

The results reveal that insurance professionals prioritise expertise, transparency, and effective processes over tech-driven features. This highlights how top insurance claims insurers excel in core service delivery and claims management while acknowledging that digital tools enhance rather than define the overall experience.

Insurance claims carriers set gold standard in claims excellence

The multi-award-winning insurance organisation has built a reputation for claims excellence based on its expertise and knowledge, speed of service, streamlined claims journey, and proactive communication with all stakeholders.

Arch UK has earned public praise from clients for its expertise in handling significant property damage claims while prioritising business continuity and client satisfaction.

“What truly sets us apart is our unwavering focus on putting clients first,” says Craig Ashcroft, vice president and regional claims manager for the UK. “We don’t merely aim to meet industry standards; we consistently strive to exceed them, establishing new benchmarks for claims excellence in the insurance sector.”

“We pride ourselves on our multicultural workforce that brings together talent from all backgrounds. This inclusive approach ensures we benefit from varied perspectives, leading to innovative client solutions”

Craig AshcroftArch Insurance UK Regional

The 5-Star claims insurer’s approach combines technical expertise with a genuine commitment to customer service, ensuring that every claim receives the utmost professionalism. Arch’s leadership embraces an entrepreneurial and collaborative approach where every team member has a voice.

“Our claims handlers are empowered with significant autonomy in the claims process, allowing them to make informed decisions quickly and efficiently,” adds Ashcroft. “This ownership mentality leads to faster resolutions and better outcomes for our clients.”

The best insurance claims insurer prides itself on having a claims team solidified by longevity of service. Many of its team members have been with the company for over two decades and demonstrate their care for clients and colleagues, and the strong reputation it has built by going the extra mile in each case.

Travelers actively recruits new talent at all stages of their careers to create bench strength in all facets of its claims operations.

“Transparency is key. What we do, in many respects, goes beyond cover. It’s about working collaboratively with our brokers and customers, reporting out to the insureds and working cohesively within the market”

Judy O’NeillTravelers Europe

“We have a philosophy of collaboration, where more heads are better than one, and we also rely on our extended claims team in the US, utilising their fantastic resources and talent as part of a broader community,” explains Judy O’Neill, chief claim officer for Europe.

One such common resource in the US is a full-scale catastrophe centre, which boasts real-time storm tracking, a risk lab, an auto lab to recreate accidents, and a drone zone.

That spirit of cooperation has been instrumental in Travelers’ recognition as a 5-Star claims carrier and extends to its broker and client relationships.

A cut above in expertise and client service

At Travelers, joining forces with its brokers and customers means genuinely listening to what they want and need. A broker survey conducted in recent times revealed two things high on their priority list: speed of service and expertise.

The top insurance claims carrier addressed that finding in several ways:

-

took the time to step back and reflect on how to improve those areas

-

reorganised its team into a central hub featuring a core claims team focused on non-complex cases and a complex claims division to handle large losses and cases with layers of complexity

The company already ensured staff with the appropriate expertise were working in specialised areas, such as qualified solicitors handling solicitors’ claims, instilling broker and customer confidence.

“This restructuring addressed both expertise and speed, and we still work closely together because a core claim can easily turn into a complex claim, but this allows staff with greater depth of expertise and experience to deliver on that,” O’Neill adds.

The team’s fraud prevention expertise has been showcased by producers of the popular BBC show Claimed and Shamed to dramatise third-party fraud claim cases.

O’Neill notes that exaggeration claims are top fraudulent activities, where an insured inflates injuries or reports untrue accidents.

While Arch Insurance UK Regional’s claims excellence is built on guiding principles that address brokers’ priorities of expertise, transparency and client service. Its claims team comprises industry veterans and subject matter experts across diverse business lines. This deep-rooted expertise enables it to handle complex claims with precision and insight.

Leaders continuously invest in their team’s professional development, ensuring their knowledge base remains current and comprehensive. This expertise translates into faster, more accurate claims resolutions and better client outcomes.

Arch has revolutionised its approach to stakeholder engagement through various initiatives, boosting transparency and client service:

-

appointing a dedicated claims relationship manager, creating a direct channel for enhanced broker-client communication

-

implementing transparent reporting mechanisms that keep all parties informed throughout the claims journey

-

holding regular stakeholder feedback sessions to refine its service delivery continuously

-

prioritising proactive communication protocols, ensuring clients and brokers are never left wondering about the claims status

Team expertise at the heart of claims adjustment process

Investments in their claims relationship team have enabled two-way communication and a smooth onboarding process at the front end for brokers or insureds at Travelers. In recent complex marine claims, the team ensured proactive communication with brokers, market participants, and insureds, resulting in satisfactory outcomes under difficult circumstances.

“The team is there to handle any issue, talk them through the system and the claim,” remarks O’Neill. “We regularly meet with some of our insureds to discuss their claims experience and educate our brokers.”

Demonstrating that its claims approach extends beyond the four corners of the policy, O’Neill explains that the team skilfully navigated a claim within two days for a motor trader whose stock of over 350 vehicles had been damaged in a devastating flood.

“The team went above and beyond, getting onto their premises and getting quotes so the client knew exactly what they lost and what to tell their customers,” she adds.

Supporting clients through particularly challenging claims allows Arch to display its innovative mindset. When a local business was devastated by fire, the claims team demonstrated its exceptional crisis management capabilities through fast and decisive action. The incident, which destroyed the place of business, required immediate and comprehensive intervention.

“Our response was rapid and thorough, beginning with our out-of-hours service activation and the prompt deployment of an expert from Sedgwick’s major loss team to access the damage,” Ashcroft explains.

Key actions the team took included:

-

immediate claims team engagement following the incident

-

swift policy liability confirmation

-

expert assessment and site inspection within days

-

coordinated collaboration between all stakeholders

-

continuous support throughout the rebuilding process

The recovery strategy proved successful, culminating in the business reopening just one year later and emerging stronger than ever, with several notable outcomes:

-

complete reconstruction with enhanced facilities

-

efficient cost management within allocated reserves

-

record-breaking customer bookings post-reopening

-

strong public endorsement from the owners

“The success of this case exemplifies our commitment to exceptional service delivery,” adds Ashcroft. “Our ability to manage complex claims while maintaining clear communication and providing comprehensive support resulted in not just a rebuilt establishment, but a strengthened business ready for future success.”

Innovative approaches keep top claims insurers at forefront

Several years ago, Travelers was the first UK insurer to open a law firm handling professional negligence claims, Travelers Legal. It recognised a claims challenge could arise when a case went to litigation, and the insurer had to hire outside counsel to represent its insured.

“We created a firm that only represents our insureds on defence matters,” O’Neill explains. “It’s truly cradle to grave from start to finish, and everyone shares the same philosophy; there are no competing interests.”

Travelers availed itself of a regulation change known as alternative business structure that enabled companies other than law firms to open a law firm. Travelers is also among the first UK commercial providers to use telematics in auto accident cases. Its claim team can access relevant reports in real time, including witness statements and weather maps, which increases processing speed.

Its proactive rehabilitation support program also stands out as exceptional, featuring a staff nurse who helps injured workers return to work in employers’ liability cases. The insurer also engages other healthcare specialists to provide mental health support and counselling services to their solicitor clients and others to help them recover from traumatic events.

Arch’s launch of its ‘swift claims team’ over the past 12 to 18 months has revolutionised its claims offering by significantly improving customer service and operational efficiency. The transformative results to date have been:

Streamlined customer journey

-

reduced claims lifecycle dramatically from 170 to 35 days for low-value property claims

-

simplified the process by requiring only a single estimate from customers

-

implemented immediate, personal communication strategy with direct customer contact

-

achieved 99 percent of new claims setup within four working hours

Enhanced service delivery

-

successfully handled over 810 claims in the first year

-

processed over 4,000 post items and 9,000 diary entries with 99.7 percent SLA achievement

-

reduced post turnaround times to 1.2 days

-

guaranteed claims payments within one working day of settlement

Future-focused innovation

-

developing AI-based automation for real-time claims identification and allocation

-

expanded the successful model with a new Swift team in Colchester

-

increased broker satisfaction

-

planning to expand the value threshold for claims handled by the team

“This innovative approach has become a blueprint for efficient claims handling, demonstrating our commitment to continuously improving customer service while maintaining technical expertise,” Ashcroft remarks.

- Charles Taylor

- Convex

- Crawford & Co.

- Gallagher Bassett

- QBE

- Sedgwick

- Zurich

Source