Rising uninsured losses from flooding may drive disaster insurance program expansions

The significant disparity between economic and insured losses resulting from Hurricane Helene could fuel interest in mitigation efforts and community-based disaster insurance programs, such as the one currently being tested in New York City by Swiss Re, insurtech Raincoat, and other partners, according to Josh Darr, Guy Carpenter’s global head of peril advisory.

Estimates for insured losses from Helene, a Category 4 hurricane, are in the single-digit billions, with Karen Clark & Co. reporting $6.4 billion in privately insured losses across nine states.

According to AM Best, this figure contrasts with economic losses, which are estimated in the triple digits. The insured losses cover wind, storm surge, and inland flooding damages.

Karen Clark & Co. noted that much of the damage occurred far from the storm’s landfall, with significant wind damage reported in Georgia, more storm surge damage in Tampa, and the most severe inland flooding in North Carolina.

Darr pointed out that some financial impacts of the storm are still unfolding, including the cost of claims adjustments, even if no payouts are made. He also noted the potential for business losses with broader economic consequences.

One example is the temporary closure of quartz mines in North Carolina’s Blue Ridge Mountains, which are critical to the semiconductor and solar industries. Global materials supplier Sibelco has suspended operations due to flooding, power outages, and infrastructure damage caused by Helene.

Drawing a comparison to the severe flooding in Thailand in 2011, Darr highlighted how supply chain disruptions in one sector can have global ripple effects. According to ICEYE, a satellite mapping firm, more than 100,000 buildings from Florida to West Virginia were impacted by Helene, with at least 10,000 structures inundated by five feet or more of water across several states.

Most of the damage from Helene was caused by storm surge along Florida’s west coast, even though the storm remained far out in the Gulf before making landfall on Sept. 26 with winds of 140 mph in the Big Bend region. Inland flooding also affected several southeastern states.

Darr suggested that the large number of properties affected by the storm could drive up the cost of investigating claims, even those that are closed without payment.

“From an insurer standpoint if there is clearly a flood loss there are still adjustment expenses to go out and analyze that loss… 100,000 buildings impacted across a region can become an appreciable expense to the insurers,” he said.

As of Oct. 1, insurers had received 65,716 claims related to Helene, according to the Florida Office of Insurance Regulation. This number surpasses the approximately 25,000 claims from Hurricane Idalia, which struck as a Category 3 storm last year, and the nearly 22,000 claims from Category 1 Hurricane Debby earlier this year.

Darr also highlighted the growing gap between insured and uninsured losses for flood and rain-related disasters in the U.S., emphasizing that this could encourage the expansion of insurance solutions. FEMA reports that 99% of U.S. counties have experienced a flood since 1996, yet only 4% of homeowners carry flood insurance. Despite this low uptake, payouts from the National Flood Insurance Program increased more than 660% between 2000 and 2020, rising from $9.4 billion to $62.2 billion, which FEMA attributed to climate change and rising sea levels.

Darr pointed to coastal flooding during Helene, particularly in Florida, as an example of the impact of rising seas.

He also noted that the largest discrepancies between economic and insured losses in recent history – such as in Hurricanes Katrina, Sandy, and Harvey – have all involved water damage.

What are your thoughts on this story? Please feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!

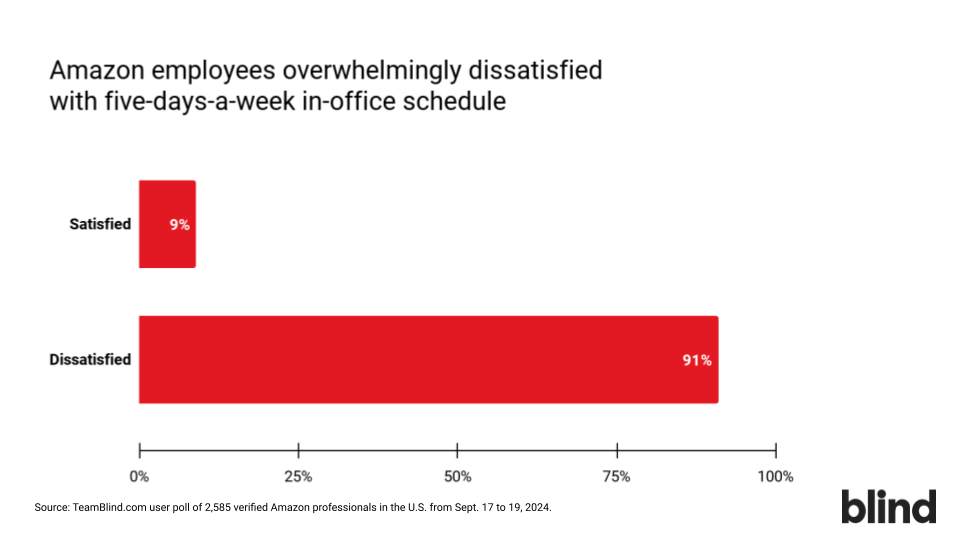

Source: Blind

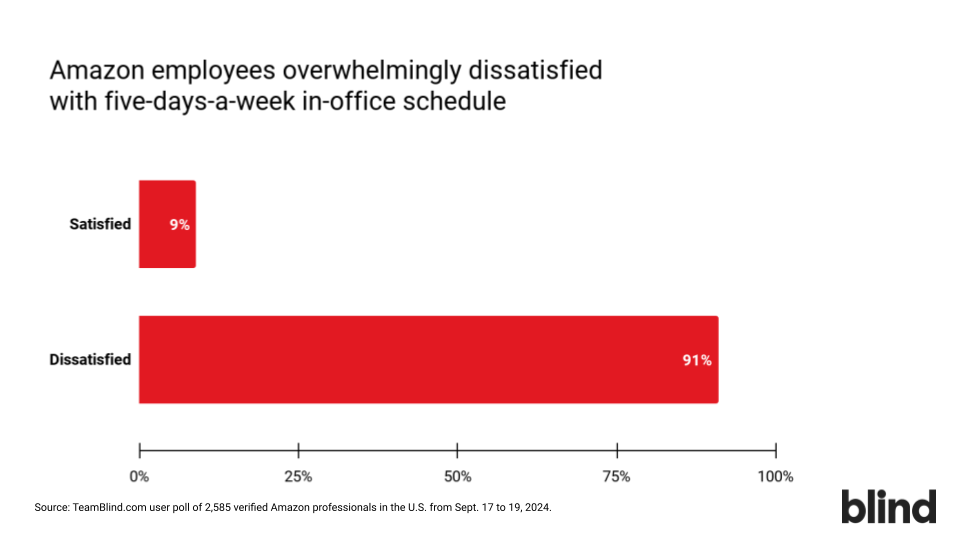

Source: Blind