The firm’s Italian investments now span Consulbrokers, Enablia (formerly wefox MGA S.r.l. and wefox Services Italy Srl), and recent acquisitions by Consulbrokers, including Intermedia I.B. s.r.l. and Etisicura s.r.l. These moves reflect a clear roll-up strategy targeting independent brokerages with established regional client bases.

The MGA sector has always been known for its agility, but this year’s MGA Opinion Report 2025, produced by the MGAA and Clyde & Co, digs into the strategic intent behind MGA growth plans in our fast-paced and ever-evolving environment. In a climate shaped by regulatory scrutiny, economic volatility, and evolving customer expectations, MGAs are not pulling back, they’re doubling down.

The report, based on survey responses from MGAs and carriers, reveals that a remarkable 84% of MGAs plan to grow by adding new lines of business in 2025. Over half (53%) are actively exploring acquisitions, and 40% intend to expand into new territories. These figures reflect a sector that is not only resilient but resolutely forward-looking.

Carriers are recognising the value in this mindset. In fact, 57% now expect to increase their capacity allocation to MGAs over the next two years, a clear signal of rising confidence in the MGA model as a key lever for market reach, innovation, and underwriting expertise.

AXA responded with an application for summary judgment or strike out, arguing that the claims were time-barred under section 5 of the Limitation Act 1980 and had no real prospect of success. The court examined the policy’s terms closely. The policy covered buildings, rental income, and public liability, with Mode as the sole insured. The sums insured were £349,409 for Unit 1, and £209,645 each for Units 2 and 3, with rental income cover of £36,000, £26,000, and £24,000 respectively. The policy allowed AXA to pay out or reinstate at its option and excluded third-party rights except for the insured and insurer.

“In the short term, we will likely see continued volatility in the Oil market due to GCC countries holding a bulk portion of the world’s reserves,” Oostrom said. “This could have a knock-on effect with the possibility of reduced supply that impacts both imports and exports, likely leading to a spike in prices. As we know, the financial markets often see greater volatility as they react to geopolitical instability.”

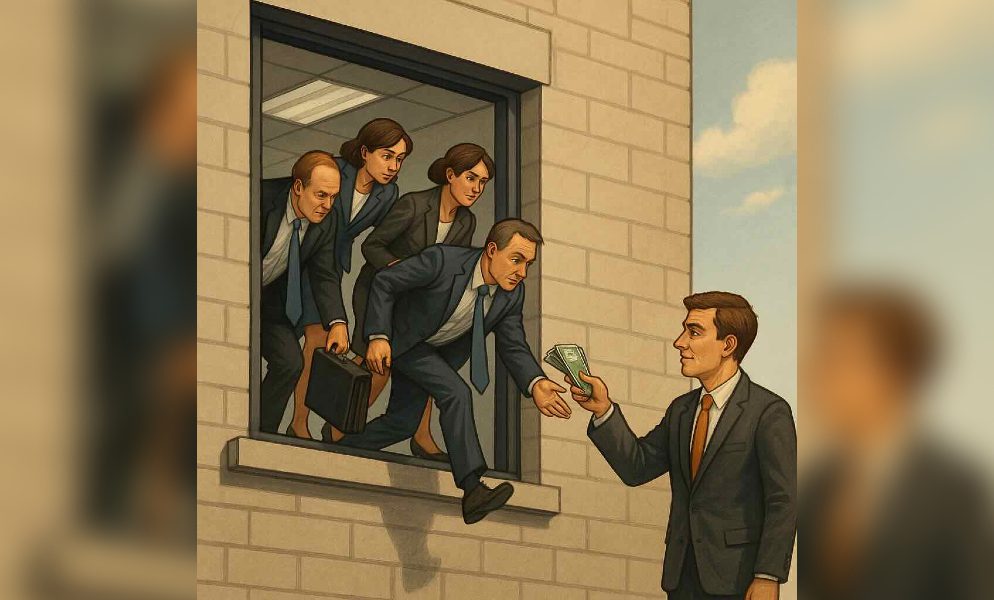

The latest salvo has come from Marsh USA, which filed a complaint in US District Court in Manhattan against four of its former senior Florida executives. The lawsuit alleges that Michael Parrish, Giselle Lugones, Robert Lynn, and Julie Layton covertly conspired with London-based Howden to rapidly launch its US operations, bringing over more than 100 Marsh employees in a sweeping defection.

This was partially offset by lower transaction costs compared to the previous year, reduced expense from the Accelerating Aon United program, and $35 million in net restructuring savings. Risk Capital operating expenses rose $136 million, or 7%, to $2.0 billion, while Human Capital operating expenses grew $139 million, or 13%, to $1.2 billion.

What are multinational clients most concerned about?

Geopolitical instability, economic volatility, supply chain disruptions, and cyber risks top the list of client concerns, according to Hyatt. But the difficulty, she said, is less about covering known risks and more about anticipating the ones clients “don’t see coming,” particularly at the intersection of different risk categories. Cyber risk is a prime example, with threats becoming more sophisticated and operating across borders.

The dispute centred on PPI policies that were underwritten by Genworth units – acquired by AXA in 2015 – and sold through GE Capital Bank, a business later purchased by Santander in 2009. At the heart of the matter were more than 650,000 customer complaints concerning PPI products, which have become emblematic of Britain’s most costly retail financial scandal, with total industry compensation surpassing £40 billion.