Exposure reduced to underperforming international markets

Qatar Insurance Company (QIC Group or QIC) has announced a net profit of QAR 194 million for the first quarter of 2024 (Q1 2024), up from QAR 175 million for the same period in 2023.

The company’s board of directors, led by Sheikh Hamad bin Faisal bin Thani Jasim Al Thani, reviewed and approved the results during their April 29 meeting.

Qatar Insurance Company’s growth in Q1 2024

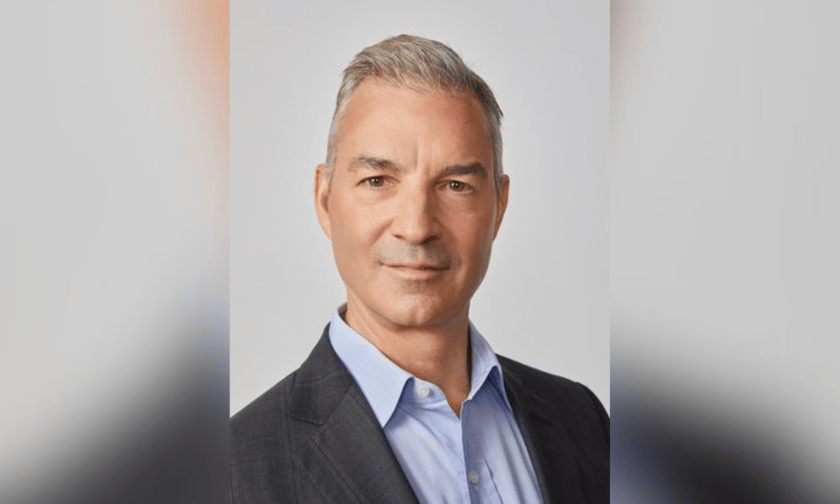

Chairman Sheikh Hamad bin Faisal Al Thani said QIC’s financial position remains robust, with the company building on progress made last year by focusing on profitable operations in Qatar and the wider MENA region while reducing its exposure to underperforming international markets like the UK.

“QIC begins 2024 in excellent financial health. The first quarter of the year saw the company consolidate and build upon the progress it made over the previous year – with a renewed focus on strengthening profitable domestic and regional businesses, extending its exceptional digital offering, and strategically improving its international operations while reducing exposure to underperforming markets. In spite of a global macroeconomic environment that remains uncertain in the near term and geopolitical challenges, QIC continues to enjoy robust growth through its core business lines, strong financials, and stable sources of income,” he said.

Supply chain disruptions linked to Brexit have increased volatility and risk in the UK motor insurance market. This volatility led QIC to scale back its UK motor insurance operations while focusing on its online motor insurance offerings in Qatar and MENA markets.

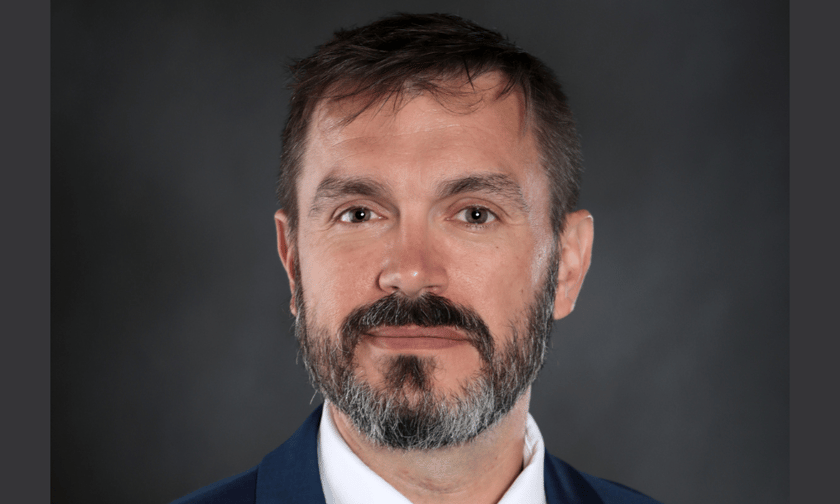

QIC Group CEO Salem Khalaf Al Mannai described the Q1 results as encouraging and mentioned significant growth in the MENA direct insurance sector.

Gross written premiums stood at QAR 2.75 billion, which was attributed to a strategy of expanding within domestic and regional markets.

“QIC’s digital innovation in particular continues to be a key point of competitive differentiation for the company. Through multiple new features introduced to the online and mobile platforms in Q1 2024, our customers in Qatar and across the GCC can expect unparalleled convenience when onboarding and fulfilling their digital needs, which is reflected in the record numbers of users that are now utilising these channels,” he said.

Qatar Insurance Company earns awards

The company also received accolades, winning the “Insurer of the Year in Qatar” and “Best Travel Insurance Company in the Middle East.”

“QIC is proud to once again have been named ‘Insurer of the Year in Qatar’ at the MENA IR Awards 2024, for the third consecutive year and ‘Best Travel Insurance Company in The Middle East’ for the second consecutive year at the Global Banking & Finance Review Awards 2024. The company has also engaged in a number of exciting recent initiatives – from operating an innovation-focused booth at Web Summit Qatar 2024, the world’s largest tech conference, to promoting insurance literacy in Qatar through a new Edutainment establishment for young people,” Mannai said.

Qatar Insurance Company’s investments

Despite global macroeconomic uncertainty and natural disasters impacting the sector, QIC saw an investment income of QAR 227 million in Q1 2024, up from QAR 223 million a year prior. In addition to the economic landscape, events like flooding in the UAE and the Francis Scott Key Bridge collapse in the US will influence future insurance claims and market dynamics.

QIC’s strategy focuses on strengthening its profitable markets in Qatar and the MENA region while reducing its footprint in less profitable international markets. The gross written premiums for domestic and MENA operations reached QAR 1.4 billion in the first quarter, compared to QAR 0.9 billion in Q1 2023. Health and life insurance now represent a more significant share of gross premiums.

Digitally, QIC introduced personalised onboarding streams and optimised its mobile and web platforms across Qatar, the UAE, and Oman. These efforts improved turnaround times and helped reach record levels of digital sales in key personal lines.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!

This page requires JavaScript