Key hire is currently deputy chairman of BIBA’s Manchester Committee

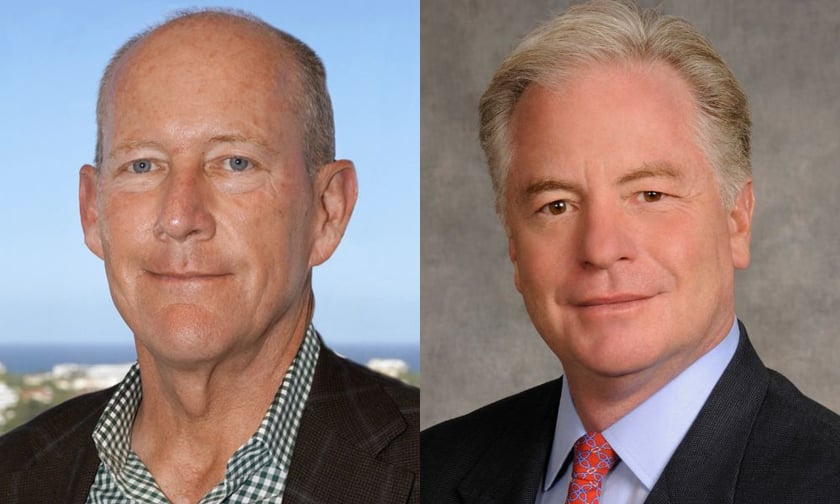

Broadway Insurance Brokers has announced the strengthening of its executive team with the appointment of Gary Ward (pictured left) as its new director of operations, internal audit, risk and compliance.

In a Press release, Broadway noted that Ward comes to the team after four years compliance officer with IC Insurance Brokers in Bolton ad brings four decades of insurance experience to his new role. He is also currently deputy chairman of the Manchester Committee of the British Insurance Brokers’ Association (BIBA).

Commenting on the appointment, CEO Daniel Lloyd-John (pictured right) said that it sends a “strong, clear signal” to clients and industry peers alike about Broadway’s ambitions.

“Gary’s arrival is something of a coup for us, given his vast experience and his standing within the profession,” he said. “The fact that he is already so well known to our existing staff will certainly help with his integration.

“More than that, however, he underlines the emphasis which we established when we launched three years ago not only about providing a different, innovative service to high net worth clients but also adhering to the most rigorous processes in order to do things right on their behalf.”

Lloyd-John added that Ward’s appointment has become “very necessary” due to the speed of growth Broadway has seen as it extends its operations from the North West across the UK and overseas. The firm recently outlined that the value of the assets for which it arranges cover doubled to more than £2 billion in the space of less than 12 months.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!

This page requires JavaScript