“We can transform insurance people’s lives for the better”, says chairman

The Insurance Charities – the only charity in the UK and Ireland dedicated to supporting professionals in the insurance industry – has issued an appeal for the profession to unite and lend its support to its upcoming annual campaign.

The weeklong campaign will encourage the insurance community to raise awareness about the practical and financial support available to insurance colleagues facing challenges. In a Press release, the organisation revealed it awarded over £1.3 million to support current and former insurance people in the last year alone.

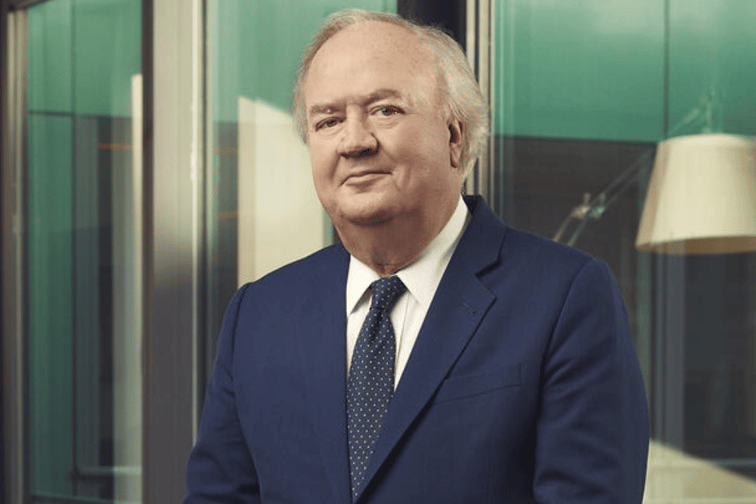

Touching on the work of the charity, which has served the insurance community for over 120 years now, chairman Joshua Brekenfeld (pictured) said: “We can transform insurance people’s lives for the better by providing a lifeline to support them and their families with whatever difficulties they may be facing. Without people coming together to raise awareness, we couldn’t reach as many insurance colleagues as we do.”

The charity is encouraging insurance professionals to spread the word using the free resources it has created to support the campaign. To do this effectively, it hopes people will talk to their colleagues and professional networks – particularly those with HR, wellbeing, and line management responsibility.

Honorary president of The Insurance Charities Adrienne O’Sullivan said: “Too often we hear from people who have faced an unexpected life event, but at the time, were unaware of the support we can provide. We want to prevent this situation, which is why this campaign is so important.”

In addition, this year, the charity is offering a special online ‘Dementia Friends’ session through its partners at Alzheimer’s Society.

How to get involved with the campaign?

Those looking to find out more about how to support the campaign will finding additional resources available on the charity’s campaign page. Those in the industry needing financial or practical support can visit: www.theinsurancecharities.org.uk.

What are your thoughts on this story? Feel free to share them in the comment box below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!

This page requires JavaScript