“It generally does not represent good value for money”

Lloyd’s is keen to provide insurance for the government, including for the NHS (National Health Service), but the powers that be do not seem convinced.

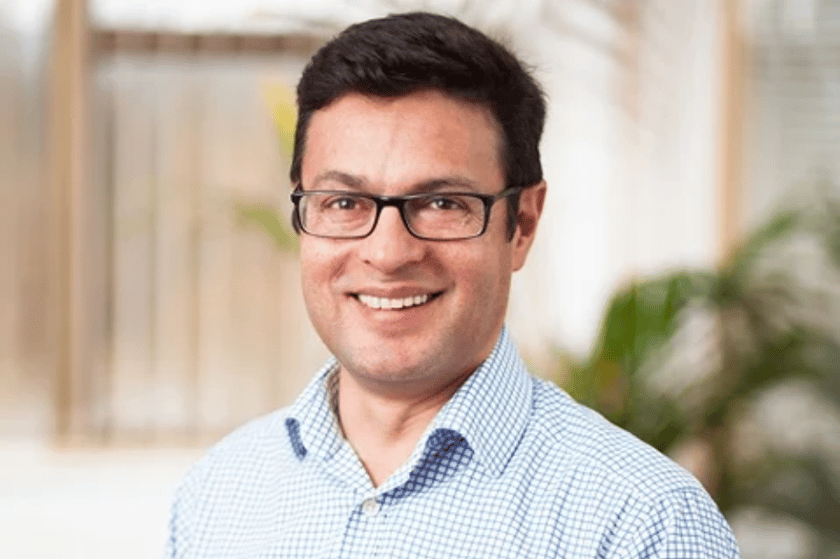

“While we appreciate the important role the insurance sector plays in building resilience to future risks, it generally does not represent good value for money for central government to purchase commercial insurance,” a report by The Guardian cited a spokesperson for the Treasury as saying amid offers from the camp of Lloyd’s chief executive John Neal and chair Bruce Carnegie-Brown.

“The government is committed to strengthening our own systems and capabilities that support our collective resilience against systemic risks.”

Risk-sharing

Lloyd’s would like to be able to offer cover for the NHS and against climate events. The possibility was reportedly put forward during a previous meeting between Neal and Chancellor Jeremy Hunt.

Subsequently, Carnegie-Brown was quoted by The Guardian as stating: “If we can provide an insurance solution that effectively funded the NHS if it breaches its capacity, or budget issues, then it would show the insurance industry responding in a positive way to something that was caused by an exogenous event.

“Obviously things like a pandemic might cause very dramatic increases in demand on the NHS and its resources.”

It was reported that ILS (insurance-linked securities) could be one way of going about it.

“It’s about understanding what the government’s risk parameters are around these kinds of issues, and historically the government has borne 100% of the risks,” the Lloyd’s chair, who believes the insurance industry can be a government partner in reducing the elements of risk, went on to assert.

“What we’re saying is that the private sector could take a share of this risk, but we would need to explore the precise terms on which we did that.”

What do you think about this story? Share in the comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!

This page requires JavaScript