Business insurance in the UK is often offered as a package of insurance products designed to provide enterprises with a full suite of protection from the various risks they face. Think of it as a form of a financial cushion that can help your business recover faster when an unexpected accident or disaster strikes.

Because each business deals with a different set of risks, business insurance providers also allow enterprises to take out a tailored set of policies that matches their coverage needs. Business insurance plans can be customised to meet the requirements of your industry, the size of your business, and your business activities, among others.

Most UK businesses are legally required to take out one type of business insurance policy – and that is employer’s liability insurance. This form of coverage works just like workers’ compensation insurance in other countries. If your business has at least one employee, then you need to secure employer’s liability coverage. Being caught operating without one can result in hefty fines for your company.

If you use a vehicle for your business, then you will likely need specialist business car insurance. For enterprises that involve direct use of their vehicles – including taxi fleets and driving schools – purchasing commercial vehicle insurance is mandatory.

The other types of business insurance policies are not compulsory, although industry experts strongly recommend that certain businesses take out specific coverages, including public liability insurance and professional indemnity insurance, especially for those providing consultancy and advisory services.

As each business faces unique risks and challenges, there is no one-size-fits-all business insurance in the UK that can cater to every coverage need. To help protect enterprises against the different risks they face, business insurance providers across the country offer a diverse range of policies. Here are the five most essential coverages for businesses operating in the UK, according to experts.

1. Employers’ liability insurance

Businesses in the UK with at least one staff are required by the law to take out employers’ liability (EL) insurance. This type of policy provides protection if your employee gets sick or sustains an injury while doing their job. Coverage, however, is not limited to full-time or part-time employees. Employer’s liability insurance is also a requirement for businesses that enlist the help of volunteers or employ staff on a casual basis.

The policy must be purchased from an authorised insurer and must cover your business for at least £5 million. Businesses caught operating without this form of cover can be slapped a £2,500 penalty by the Health and Safety Executive (HSE) for each day that they go unprotected. You can also be fined £1,000 if you do not display your EL certificate or refuse to show it to inspectors when they ask.

2. Commercial vehicle insurance

While all UK drivers are required to carry car insurance before they can hit the road, standard policies do not cover vehicles intended for business purposes. For these, you will need to take out commercial vehicle insurance. This type of policy is actually an umbrella term for all types of coverage available to businesses that use commercial vehicles. This includes:

- Van insurance

- Truck insurance

- HGV insurance

- Taxi fleet insurance

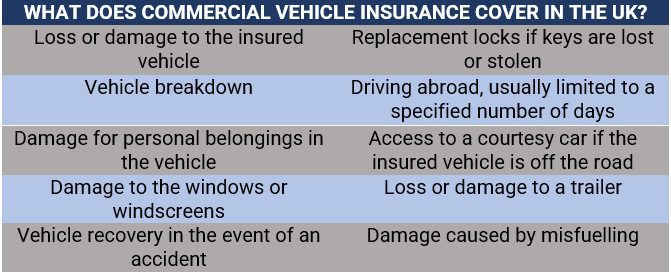

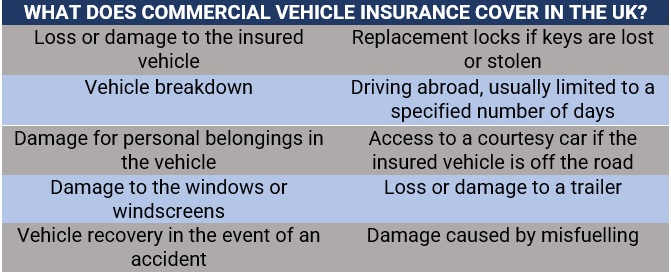

Commercial vehicle insurance operates under the same principle as private car insurance paying out for damage or injury to third parties, and repair and replacement costs to the insured vehicle. The table below lists what is commonly covered by commercial vehicle insurance in the UK.

3. Public liability insurance

One of the most popular policies for businesses, public liability insurance (PL) protects your business from claims of property damage or bodily injury resulting from actual or alleged negligence in your business activities. Although having this type of coverage is not a legal requirement in the UK, some clients and suppliers may request your business to carry one as a condition for working with them.

4. Professional indemnity insurance

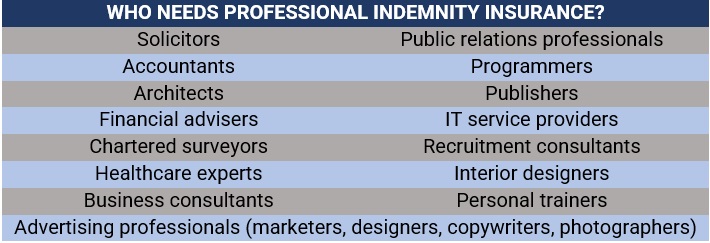

Professional indemnity (PI) insurance is designed for businesses offering professional services or advice. If you operate this type of business, PI coverage can protect you from claims arising from negligent acts or omissions committed while providing services. Professional indemnity insurance typically covers legal and compensation costs, and similar to product liability coverage, some clients may insist that you get coverage before they agree to work with you.

The table below lists several occupations in the UK that can benefit from taking out professional indemnity insurance.

If you want to know more about this type of business insurance policy, you can check out our comprehensive guide on professional indemnity insurance, which answers all the questions you may have about this coverage.

5. Cyber liability insurance

With cybercrime rapidly emerging as among the biggest risks facing businesses in the UK, it pays for companies to have some form of cover. Cyber liability insurance is designed to mitigate the financial impact of data breaches and cyberattacks. Coverage typically includes legal and compensation expenses, and the cost to restore data.

If you’re wondering what type of coverage cyber insurers in the UK are providing, you can check out our latest list of the country’s top cyber insurance companies.

Cyber liability insurance, however, offers only one layer of protection against cyberattacks. To be optimally protected, you should pair cyber coverage with good cyber hygiene and sound cybersecurity strategies.

Apart from the essential coverages listed above, UK businesses can purchase several other types of insurance policies that can cater to their specific needs. These include:

- Business contents insurance: This protects a business’ physical belongings essential to its daily operations, including laptops, smartphones, and other mobile devices. It also covers damages or losses caused by theft, fire, flooding, and other covered events.

- Business interruption insurance: This protects businesses from loss of income and additional costs incurred if their operations are forced to shut down because of an unexpected event.

- Equipment breakdown insurance: This covers businesses against sudden and unexpected mechanical or electrical failure of essential equipment by paying out for the repair or replacement costs.

- Personal accident insurance: This is designed to minimise the financial impact of losing a key employee, if a job-related accident causes them to miss work, usually for a period of two weeks or longer. It pays out for lost income, medical costs, and hospitalisation, up to the limits of the policy.

- Product liability insurance: This covers businesses if a customer suffers an injury or property damage resulting from the use of their product. It typically pays out legal and compensation costs.

- Tools insurance: For tradespeople who rely on their tools to get the job done, tools insurance covers the cost to replace or fix industry-specific instruments if they are lost or damaged.

Premium prices for business insurance in the UK are usually determined by a range of factors. These include:

- The business’ size or number of employees

- The industry your business is in

- The type of business insurance policies you are taking out

- The level of cover

- The excess amount

- The business’ claims history

- The professional background of the executive team

- The company’s turnover and debt

If you want to know how insurance companies calculate the cost of your policies, you can check out this comprehensive insurance premiums guide that we have prepared for you.

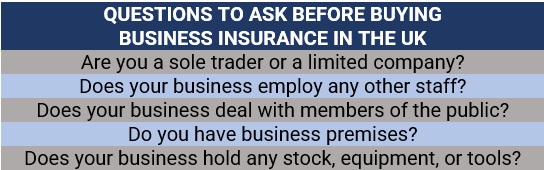

Before taking out a business insurance package, the first thing you should do is work out the types of coverage your business needs. Here’s a list of questions you can ask yourself to find out which policies suit your operations best.

It would also be helpful for you to consult an experienced insurance agent or broker who can give you sound advice regarding which business insurance policies fit your needs.

One thing to take note of is that as a self-employed individual, you should be able to claim your business insurance costs as an allowable expense to reduce your taxes, according to GOV.UK.

All businesses, regardless of how big, can benefit from taking out business insurance in the UK. If you’re self-employed and don’t employ anybody else, then you can skip employer’s liability insurance. Same with commercial vehicle insurance if you do not use a car for your business.

Other types of policies, however, may prove useful. If you offer professional advice or service, for instance, then professional indemnity insurance can protect you from claims of losses that resulted from the services you rendered. Public liability insurance, meanwhile, covers you if someone gets injured or had their personal belongings damaged because of your business activities.

Technically, yes. But are you willing to take that risk? If you do not have employees and company vehicles, it is possible to operate a business without insurance as employers’ liability insurance and commercial vehicle insurance are the only types of business policies required by the law.

But should an unfortunate event happen to your business – for example, theft, natural disaster, or lawsuit – it could run your operations to the ground without proper coverage. So, while technically you can, it is not advisable for you to run your business uninsured.

It’s not just UK enterprises, however, that can benefit from business insurance. Companies around the world all need the right type of coverage to maintain some level of financial security. Learn how you can use business insurance to navigate global challenges in this guide.

Do you think it’s worth investing in business insurance in the UK? Which coverages do you think are necessary and which ones are not? We’d love to hear from you in the comment section below.