Jump to winners | Jump to methodology

Insurtech innovators

Insurance Business recognizes the Global 5-Star Technology and Software Providers of 2024.

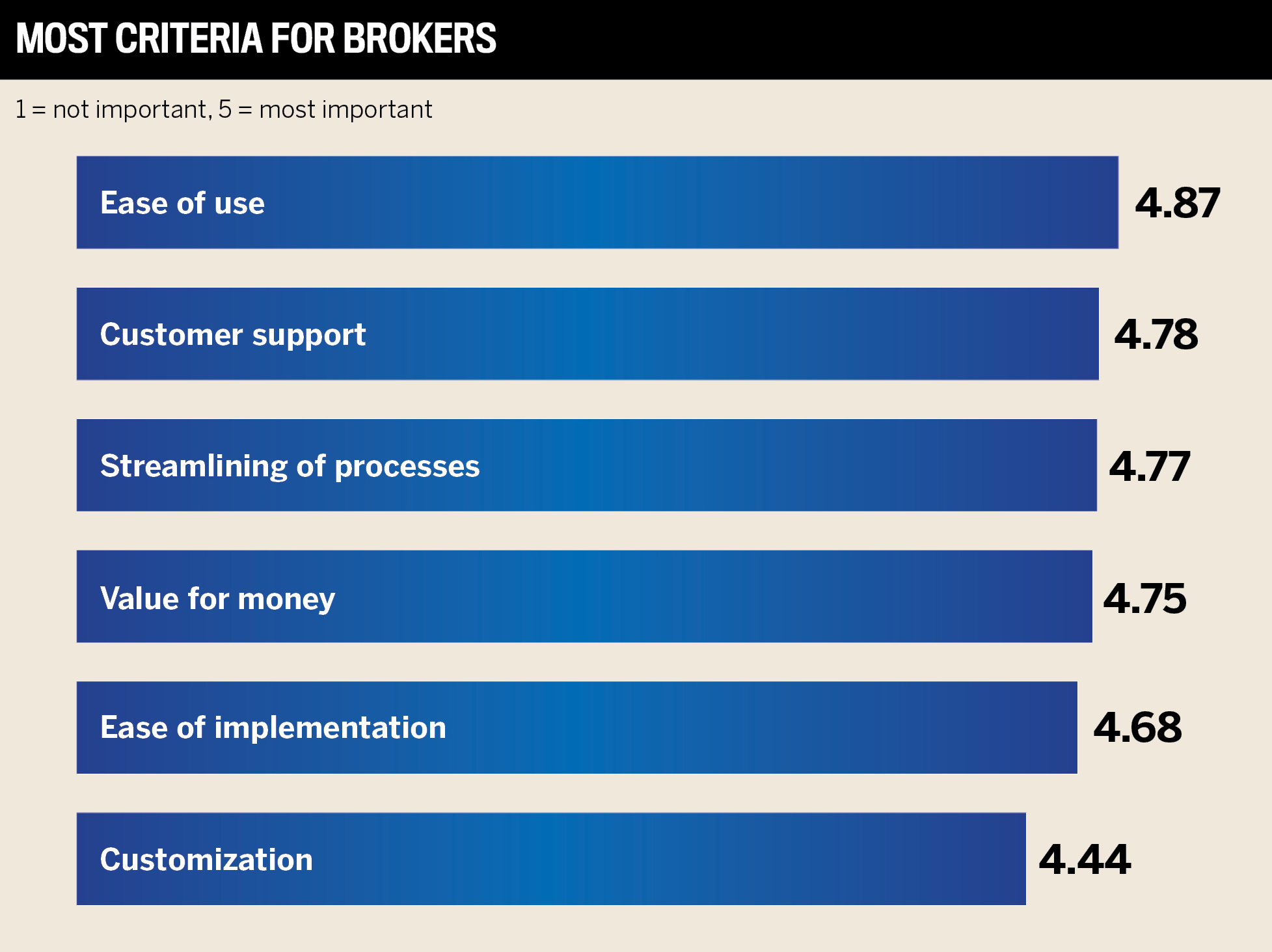

During a 15-week process, IB’s research team conducted interviews with brokers and surveyed thousands more within IB’s global network to gain expert insight into what insurance professionals think about the current market and who are the top insurtech companies.

Additional data shows how insurtech is a vital part of the industry and is expected to undergo incredible growth.

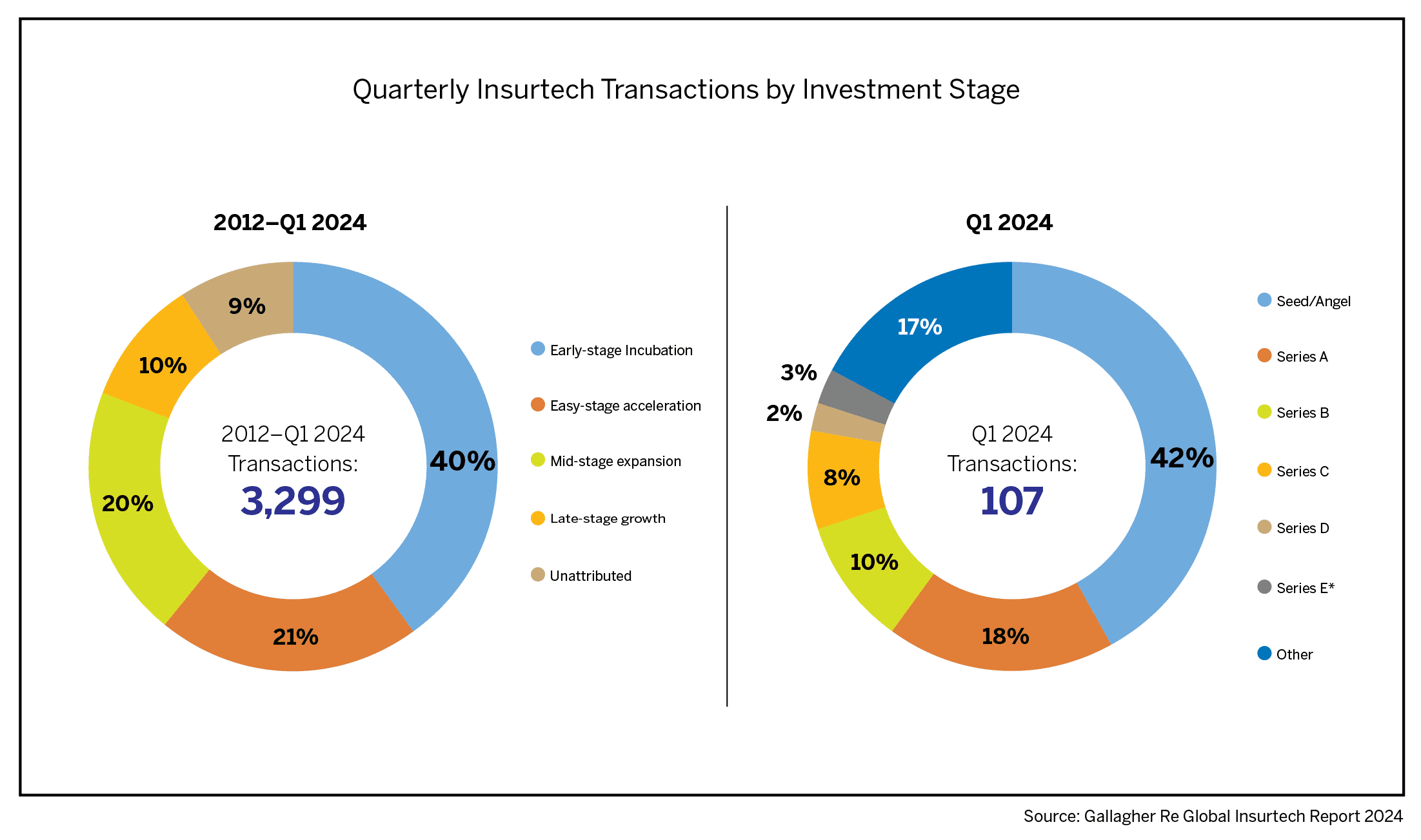

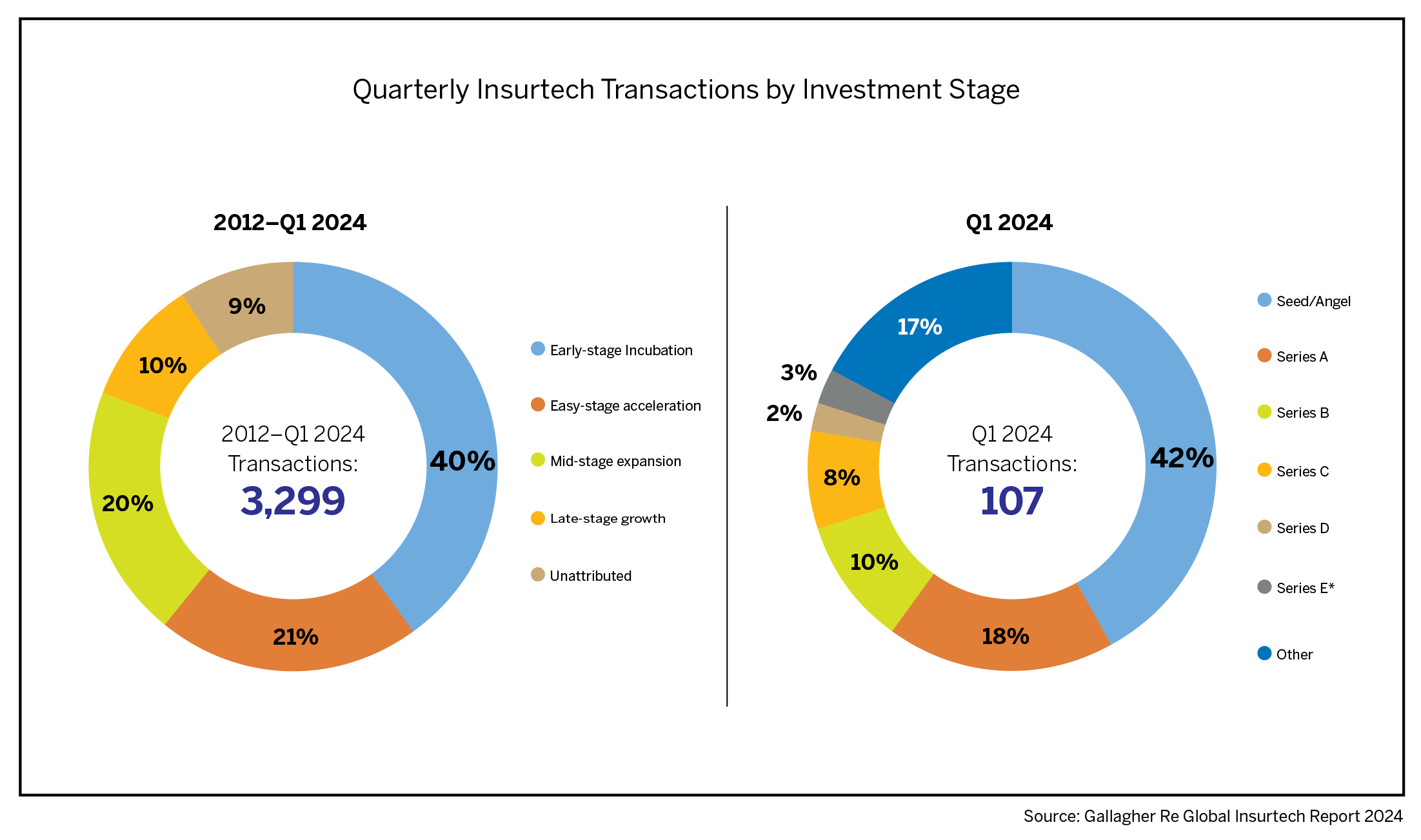

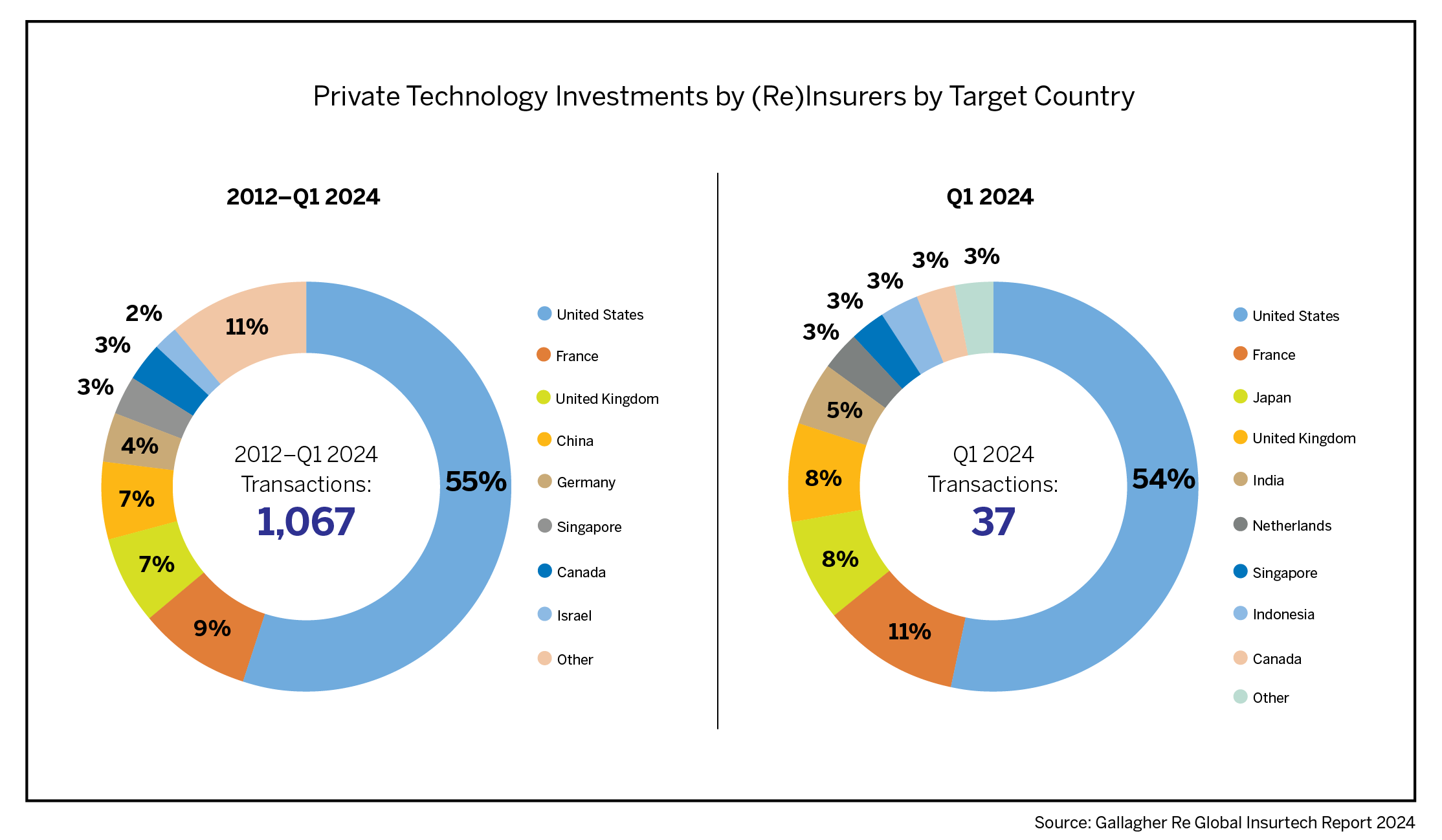

Gallagher Re’s Global Insurtech Report 2024 highlights this by focusing on the stage of investments for those firms looking to become top insurtech companies.

Additionally, Market.us data shows:

-

By 2032, the projected value of the insurtech sector is estimated to be US$336.5 billion.

-

By 2032, the sector is projected to undergo a compound annual growth rate (CAGR) of 41%.

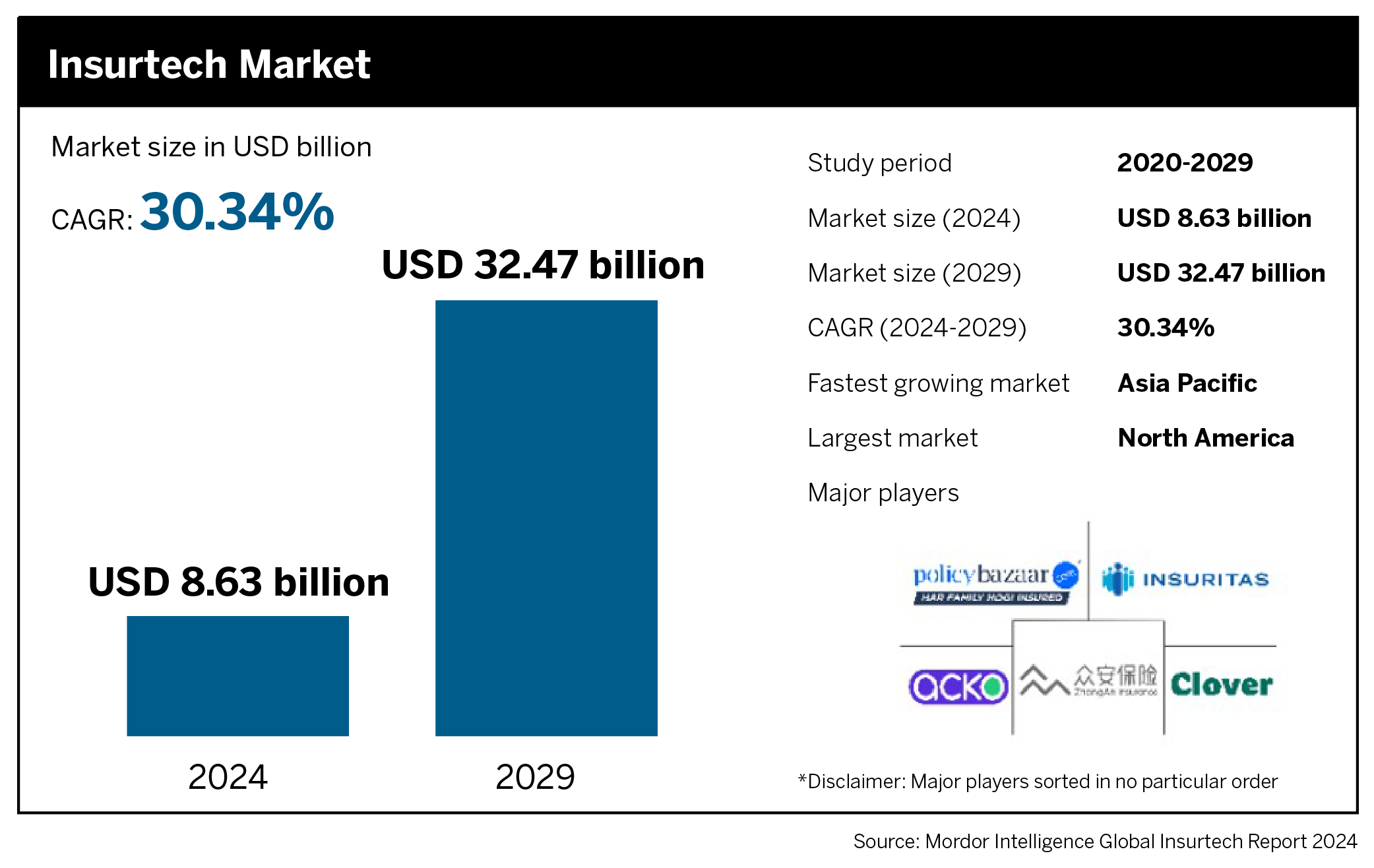

Mordor Intelligence predicts a similar steep trajectory but rates the insurtech market at a lesser value:

-

market size in 2024: US$8.63 billion

-

market size in 2029: US$32.47 billion

-

CAGR in 2024-2029: 30.34%

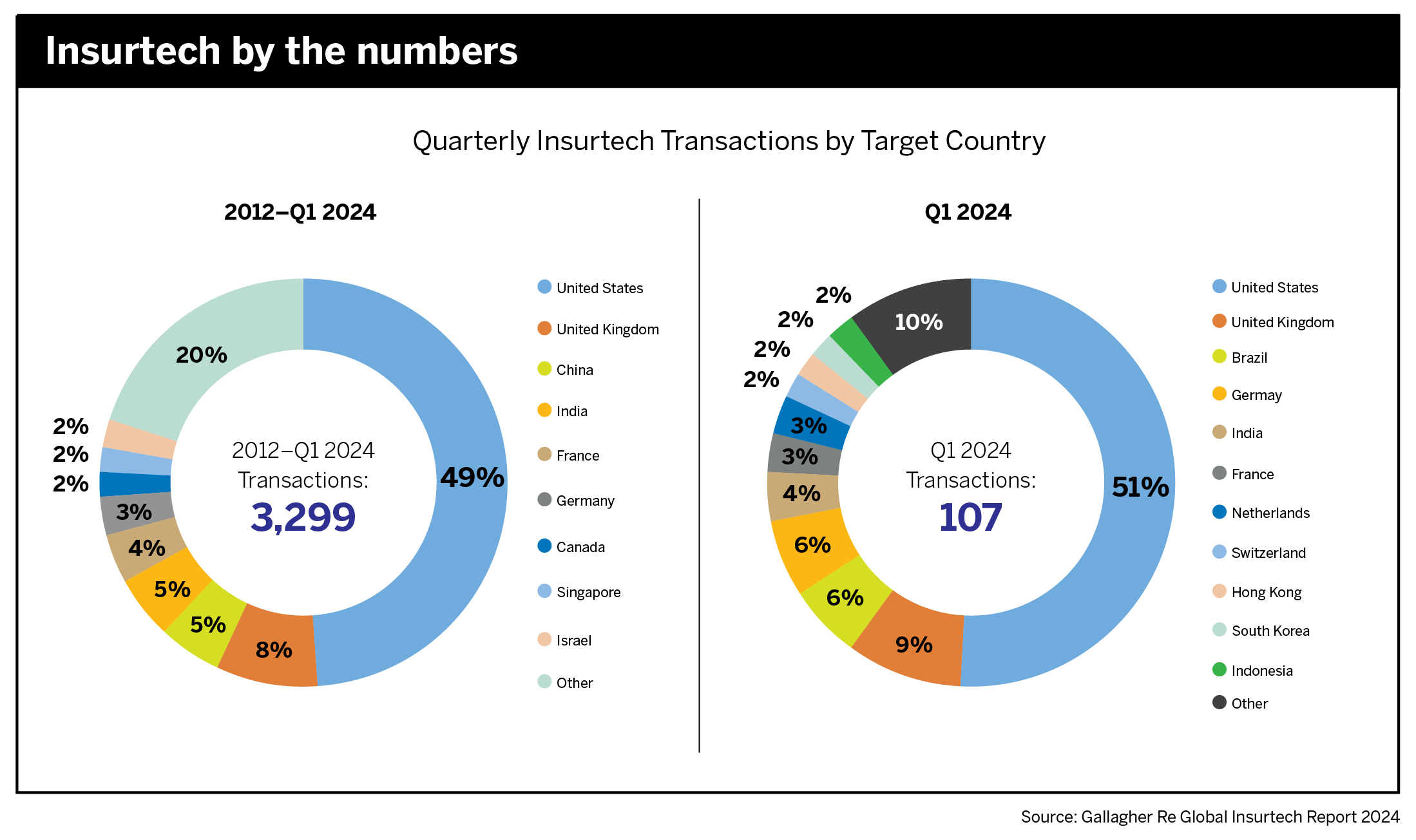

The United States is currently the largest region in the insurtech market, with some estimates reporting that it accounts for around 50% of the global market. Other dominant nations include the United Kingdom, France, and China.

Expert opinion

David Gritz, co-founder and managing director of InsurTech NY, shares an insight into the market-leading standard for the criteria used by IB’s criteria to determine the 5-Star Technology and Software Providers of 2024.

Ease of use

“The obvious ones require relatively limited training and no need for development resources on the carrier side,” says Gritz.

Gritz also points out that some insurtechs have begun as fintechs, so they have to ensure their “language and design are based on workflow on the partner side.”

He adds, “To tell their clients they need to do a highly technical implementation or a data scientist resource, I don’t want to call it a no-go, but it pushes the project success rate substantially lower.”

Customer support

“The bar is so low on customer support; most insurtechs don’t even have a form that works on their website. Successful insurtechs will have a phone number that a live person answers, or they’ll have a form that, if filled out, gets a response.”

Gritz also underlines the need for top insurtech companies to be truly global, particularly American organizations.

He says, “There’s this assumption that US companies can do business anywhere. A lot of founders don’t realize that, if they’re coming to the UK, Europe, or Singapore, they need to have local resources in the same time zone that can provide the same level of service as local insurtechs.”

Streamlining of process

“A general rule of thumb is that if the insurtech can demonstrate that it reduces a full-time equivalent by their process, there’s a meaningful improvement.”

Gritz also suggests the insurtech show:

“It’s very important to have an objective measure of how the processes can be streamlined,” Gritz says.

Value for money

“If it’’s a data business model, it’s very simple. If you’re cheaper than one of the other major providers for the same data source, then it’s a pure dollar and cent comparison,” says Gritz.

But in enterprise software, Gritz points to the key points of:

Ease of implementation

The key questions for Gritz in this area are:

Customization

“If the start-ups want to be very tailored, then they should offer this. But there’s insurtech where it doesn’t make sense. If they do custom development, it actually harms the carrier because it prevents them from streamlining their processes. Insurtechs in this position have to be careful that they’re not doing customization; they’re just fitting the old process instead of enabling the carrier to use a newer, better process.”

The result of what matters to brokers in determining the top global insurtech companies is shown below:

Location: New Zealand

Grappler’s solution is designed to transform the back office administrative processes of the commercial insurance sector by automating existing manual processes in a scalable manner.

It allows clients to:

“We are constantly evaluating new trends and applications of emerging AI technologies to see how they could benefit our clients if applied”

Alistair HaroldGrappler

Co-founder and CEO Alistair Harold highlights how the top insurtech company stands out in IB’s criteria:

Ease of use

-

“Our implementation team works closely with customers to understand their specific data and business requirements, ensuring we configure a solution that meets their needs. We describe ourselves as a managed SaaS, meaning our customers don’t need to be experts in our software. Our team manages all ongoing setup and configuration changes on behalf of the client.”

Customer support

-

“Our business model is subscription based, so customer satisfaction is essential to earning customer renewals. We work closely with our customers through regular customer user group forums to understand both their ever-changing reporting (legislative, regulatory, operational, etc.) and functional requirements, and we will continue to add functionality, dashboards, reports, and analytics to provide greater insights into debtor data and leverage predictive analytics.”

Value for money

-

“During the sales process, it is important to get executive buy-in and for customers to really understand the business benefits they can achieve as a result of using Grappler. Once they see a demo of the solution, they start to understand how we can save them time and money and also improve processes and give them greater transparency of their debtor position, credit control process, and reconciliation with partners.”

The firm also has a focus on keeping pace with ongoing challenges in the tech world.

“Grappler has the benefit of being built as a cloud native product eight years ago. Having a solid foundation in modern architecture allows us to easily remain current on new technologies that will add value to our product and ultimately add value to our end users,” explains Harold.

Location: USA

Making its name by creating a solution for how surplus lines taxes should be filed. It began with InsCipher looking to organize and automate complex insurance tax issues as its tax division grew. However, the top insurtech company could see long-term scalability issues without better tools; hence, it designed its own.

Jason Russon, vice president of sales and marketing, explains, “To date, no other company has been successful in creating comprehensive surplus lines tax software, especially to this size and scope. There was no playbook for what we were building, and the learning curve was steep. However, we see now that this steep learning curve is a key competitive advantage for anyone thinking of entering surplus lines for tax compliance.”

“Someone will always try to take a good idea and apply the latest tech to make it better. We want to be that someone”

Jason RussonInsCipher

Russon below comments on InsCipher’s key commercial strengths in relation to IB’s criteria:

Ease of use

-

“Our strong relationships with state regulators and industry leaders give us an unparalleled understanding of the compliance landscape and its complexities, which in turn influences how our software functions.”

Streamlining of processes

-

“We simplify surplus lines taxes. Specifically, the ‘pain points’ that we relieve include eliminating repetitive manual reporting tasks, time-consuming compliance research, and tracking hundreds of state reporting deadlines across the country. The cost of noncompliance is high, with penalties including high late fees and even the potential loss of insurance licenses.”

Value for money

-

“Our clients write hundreds or even hundreds of thousands of E&S policies annually. The fines and fees associated with reporting policies incorrectly can be significant, disrupting business for our customers. To date, there hasn’t been a simple way to report E&S taxes across all 50 states. InsCipher’s suite of products and services takes what was a complicated problem and makes it easy for agencies to focus on their goal of selling more insurance.”

Location: USA

Understanding the unique needs of public sector employers, the top insurtech firm offers consultative implementation and provides a benefits and administration tailored platform.

The firm prides itself on:

“We serve a specific market and focus on those changes that have the most impact on state and local government and education employers. This allows us to improve on what we do best, ensuring that our solutions are not only comprehensive but also the best in their class”

Julie FinkBentek

President Julie Fink provides her insight on how Bentek meets several of IB’s criteria:

Ease of implementation

-

“Our approach to client success is founded on the premise that ‘we do the heavy lifting.’ That starts with implementation; we utilize a consultative approach to gather information instead of handing clients a blank document to complete. We find having conversations leads to a deeper understanding of the client’s current state and their unique needs, not to mention the invaluable connections and friendships that are developed.”

Customization

-

“Over the past 12 to 18 months, we have made significant refinements to our benefits administration, including Retiresweet, our proprietary retiree administration module offering a single platform to manage eligibility for all members, actives and retirees. This module is highly configurable, catering to various retiree groups with different needs. We have also focused on refinements that are designed to improve the user interface and navigation within the platform, making it more user-friendly and accessible, and enhancing overall engagement and satisfaction.”

In addition, the firm is not standing still and is innovating to maintain its edge.

“We prioritize innovation and leverage advanced technologies such as AI in our business to create efficiencies and eliminate redundant tasks for our team members,” adds Fink. “AI is evolving every day, and we are excited to continue exploring ways it can enhance the platform and further improve the personalized user experience.”

- Advisr

- Applied

- Ascend

- At-Bay

- BizCover For Brokers

- BriteCore

- CDL

- Foxquilt

- Grappler

- Insurance Systems

- InsuredHQ

- JAVLN

- ProNavigator

- QuickFacts

- RedBook New Zealand

- SSP

- Surefyre

- TAP

- Total Systems

- Trufla Technology

- Wilbur