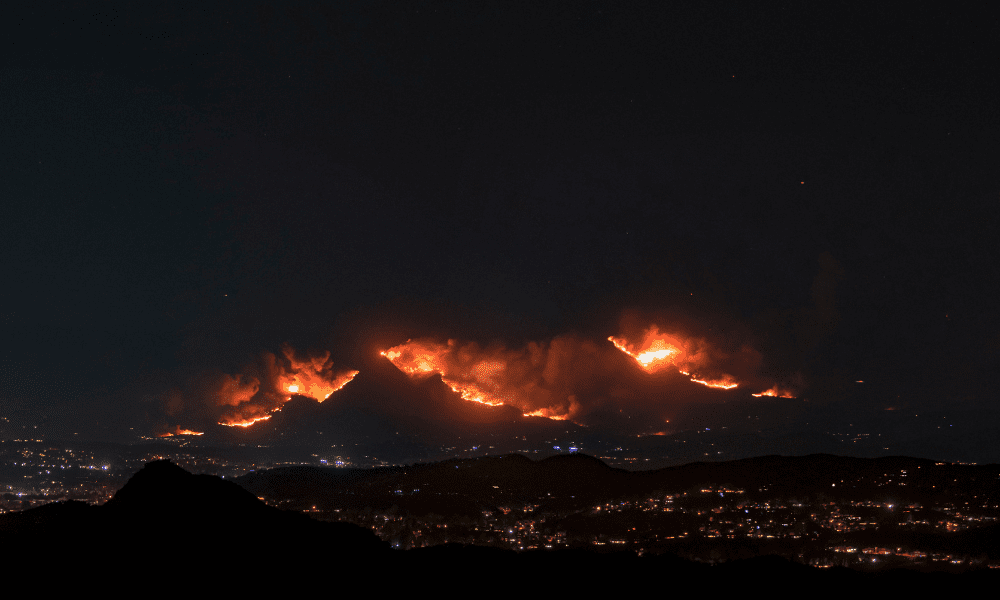

Peacock identified multiple factors contributing to the escalating insurance costs in California. “You’ve got more expensive real estate, you have more real estate built … into the fire zones, and then there are all manner of conditions and situations in California that make that even more challenging,” he said. He also highlighted the inflationary pressures driving up the costs of both homes and cars, making repairs and purchases more expensive. Furthermore, the risk of extreme weather events, such as wildfires, has increased, complicating the ability to set appropriate insurance rates in the state.