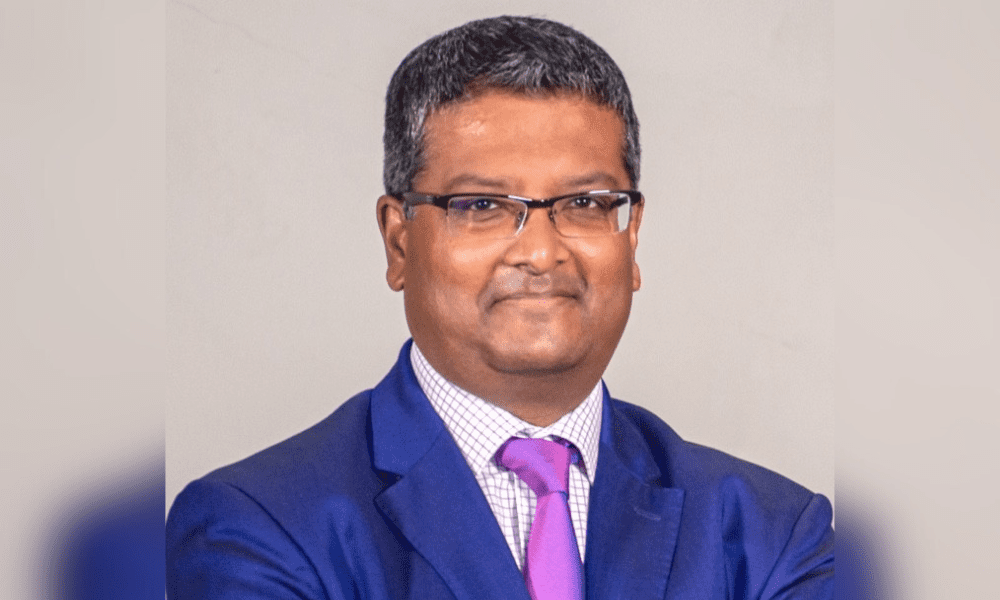

The newly launched practice will assist insurers in optimizing capital positions, reducing earnings volatility, and enhancing product design and distribution. These efforts, Aon said, are geared toward improving shareholder value and addressing key challenges in the rapidly evolving insurance market.