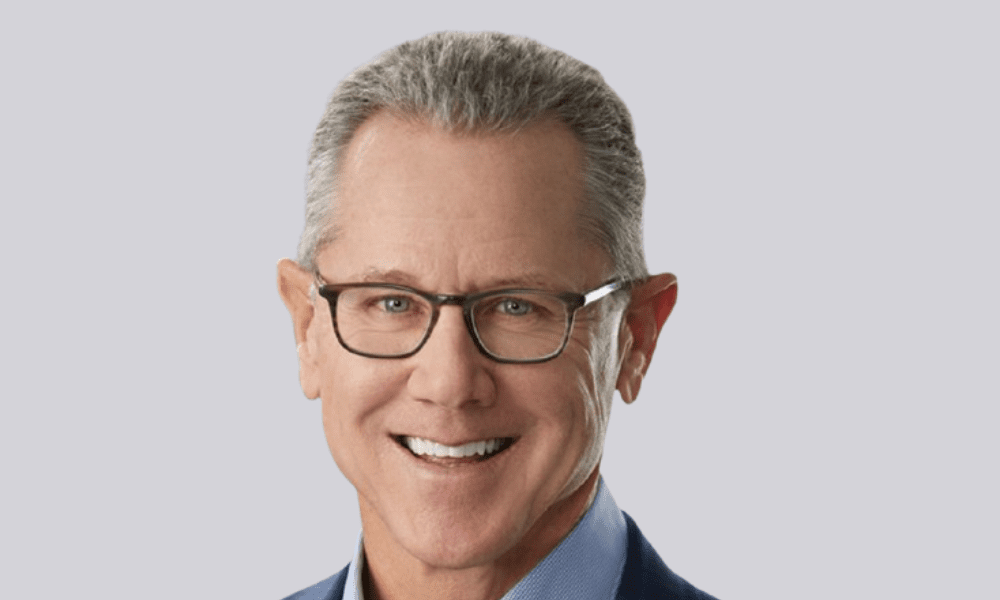

“Many types of investors, from pension funds, and also private equity, are providing the needed capital to fund the pension protection gap through a variety of mechanisms, including delivering higher returns, investing in pension-related liabilities, partnering with insurers, and offering innovative retirement products.”