Structural changes helped keep the industry afloat as insurers take brunt of damages

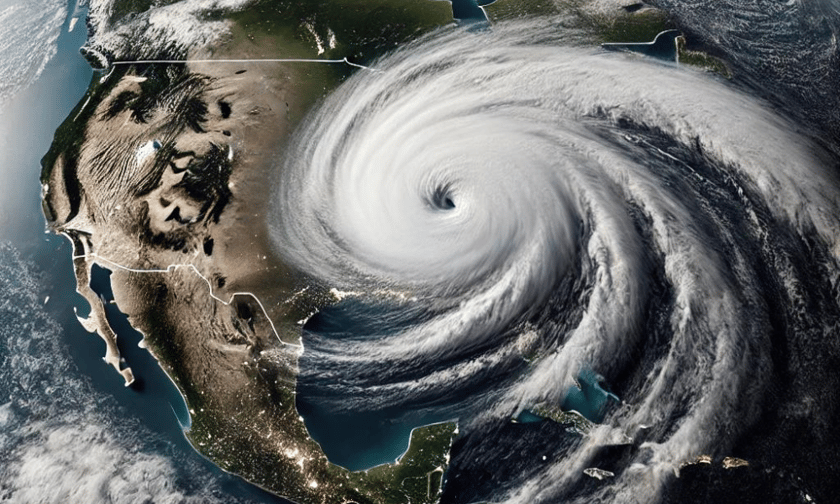

In 2023, global insured losses from natural catastrophes surpassed $100 billion for the fourth consecutive year, underscoring the financial burden posed by increasingly frequent natural disasters.

A significant portion of these losses originated from medium-severity severe convective storms (SCS), particularly in the US, according to insights from S&P Global Ratings.

However, reinsurers faced less exposure to these losses in 2023, thanks to structural changes in reinsurance practices and strategic actions taken during renewals. These adjustments included moving up in reinsurance towers, offering scaled-down limits to cedents, reducing exposure to lower-return period events, tightening terms and conditions, reducing aggregate covers, and repricing risk.

S&P noted that these measures helped reinsurers achieve strong overall performance in 2023 and the first half of 2024, while primary insurers, especially in the US, contended with increased retentions and absorbed the majority of SCS-related losses.

Over the past 18 months, S&P has not downgraded any reinsurers due to natural catastrophe losses, but some US primary insurers have seen negative rating actions where elevated natural catastrophe losses have affected their underwriting performance.

As demand for natural catastrophe reinsurance remains high, it will be critical to monitor whether reinsurers can maintain underwriting discipline amid competitive pressures, which could impact future profitability.

According to the Swiss Re Institute’s Sigma report, global insured losses from natural catastrophes have grown by an average of 5.9% annually from 1994 to 2023, outpacing global economic growth, which averaged 2.7% annually.

The report projects that insured losses will continue to increase by 5% to 7% annually, consistent with trends observed over the past three decades. S&P highlighted that 2023 was the fourth consecutive year in which insured losses exceeded $100 billion, a level that may now be considered the norm.

In 2023, the highest insured losses stemmed not from any single catastrophic event but from a high frequency of medium-severity events, including the Maui wildfires, which caused $3 billion in insured losses – the largest ever recorded in Hawaii.

Losses from secondary perils, including SCS, surged by about 53% to $87 billion in 2023, accounting for approximately 81% of global insured natural disaster losses. S&P observed that this was nearly double the 43% share reported in 2022.

SCS accounted for $64 billion in insured losses in 2023, a record amount that comprised 60% of global insured losses from natural catastrophes – more than double the 10-year average. The majority of these losses, about 84%, occurred in the US, though Europe and other regions also saw increases.

S&P noted that hail damage, responsible for 50% to 80% of SCS losses, was a key driver. In Europe, SCS insured losses exceeded $5 billion annually for the past three years, with Germany, France, and Italy experiencing the most significant impacts.

S&P identified several factors contributing to the rise in global insured losses from natural disasters, including economic and population growth, urbanization, inflation, and the potential impacts of climate change. The concentration of high-value properties in catastrophe-prone areas, such as coastlines and flood plains, also plays a role.

While the exact causes of these trends are debated, S&P noted that the growth in SCS loss costs is primarily driven by inflation, followed by economic and population growth, which lead to more valuable insurable assets. Climate change is also considered a contributing factor, though it is more difficult to quantify.

Since 2017, the reinsurance sector has faced challenges due to the increasing frequency and severity of natural disasters. However, in 2023, the market saw a significant shift, with reinsurers implementing structural changes such as raising attachment points and managing limit profiles more cautiously.

S&P reported that these actions improved reinsurers’ underwriting performance, as natural catastrophe losses in 2023 did not reach the thresholds required to trigger reinsurance policies, leaving primary insurers to bear the brunt of the losses.

Despite the continued high level of global insured losses, reinsurers experienced a reduction in the impact of natural catastrophe losses on their underwriting earnings. According to S&P, the impact on the combined ratio of 10 selected reinsurers fell by 5.5 percentage points in 2023, compared to the average of the previous four years.

In contrast, primary insurers in the US saw an increase in the impact of natural catastrophe losses on their underwriting results, as they retained more risk.

Looking ahead, S&P believes that the events of 2023 will likely influence risk management and mitigation strategies, with primary insurers seeking solutions beyond rate increases. These strategies may include refining risk models, improving exposure-data quality, increasing deductibles, and enhancing the physical durability of insured assets.

However, S&P noted that secondary perils like SCS are not as well modeled as primary perils, making it challenging for insurers and reinsurers to have a comprehensive view of risk.

While the exact drivers of rising loss costs remain debated, S&P emphasized that understanding and managing natural catastrophe risk is essential for both insurers and reinsurers in the current environment.

What are your thoughts on this story? Please feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!