Read more: Ranking how the UK’s top 50 insurance brands are tackling digital marketing opportunities

“The environment has changed, in the sense that big tech companies have changed the game, they’re digital, they deliver faster, they understand the need for a seamless experience and to understand customer data. They have disrupted what we do,” she said. “Then on the other side, insurtechs are also disrupting what we do because they have the digitally native [foundation needed] to be faster, more seamless and more engaging than us.

“Of course, they may not be as big or as dominant as we are, but we should still remember the history of the disruptors that came into other industries and changed the game, such as Netflix or eBay… What we need to do is realise what is happening around us and not think that we’re different because we’re insurers. We’re not different. And customer expectations are going up because other companies are setting new standards.”

That’s why Zurich is taking on the task of actually listening to its customers through the work of Kalcher and her team, as the company wants to move with those changing standards and apply them to insurance so that customers aren’t disappointed. A variety of projects and initiatives have been developed to encourage greater customer engagement, she said, each of which moves beyond the traditional message of marketing – which essentially is to push out the same message to everyone.

Instead, it’s about exploring a new way of communicating with customers that is reflective of what they want to see, not what the company has to offer. It’s not about pushing a message out to them, but rather getting to know them so that a long-standing, productive relationship can be built through mutual understanding. It’s about making every interaction, and every point of dialogue and contact count – something that is notoriously difficult in insurance as traditionally there have been so few opportunities for interaction.

“As we build out our company and our offering to also encompass services and prevention activities, there will be more touchpoints for us,” she said. “So, what we’re doing is redefining how we engage with customers. We have redefined who we are as a brand and what we stand for. We have a stronger brand purpose today which is to ‘create a brighter future together’. That’s together with our customers – we’re not sitting on a pedestal, with the company over here and the customer over there. We are actually in this together.”

Zurich wants to change the broader conversation about insurance, Kalcher said. Insurance is typically seen as a “doom and gloom” industry where conversations centre on what could or has gone wrong, but as pinpointed by its new branding motif, the company is looking to turn that around and start promoting the ability of insurance companies to create positive changes to the world around them. And actionable positivity is at the core of this message.

Read more: Zurich introduces low-carbon investment fund

This is a step being taken across the Zurich business collectively, she said, as epitomised by the actions being led by group CEO Mario Greco to proactively address systemic risks such as climate change and cyber security. The insurer has also defined and launched a new set of customer experience standards internally that will soon start to filter down to customers. Zurich will be launching a mass engagement campaign at COP26 to outline the accumulative actions that everybody can take to preserve the planet and halt climate change.

A core component of Zurich’s branding evolution has been exploring the right channels via which to share its revitalised brand purpose, Kalcher said, and its message has to be communicated in a way that’s relatable for everyone. Upgrading a visual identity for the digital age has meant embracing more animation, more interactivity and more adaptability so that people can engage via their device of choice.

Read more: Zurich ties up with UNICEF to promote mental well-being

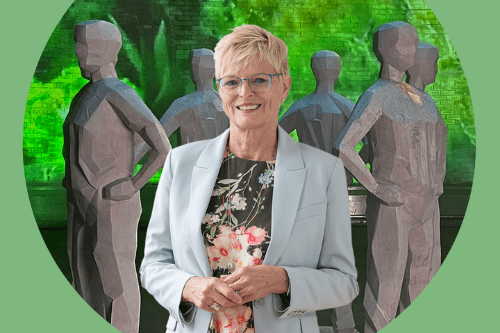

“Our new visual identity is exemplified by the statue, [as seen above],” she said. “This statue is formed of carbon-neutral material that depicts nondescript climate heroes. The idea is that you can step into the circle of people, join it and make your pledge. So, it’s really about what we all can do, what small actions we can take to support a better life for future generations and protect the planet together. It’s not about pushing a product – it’s about engaging customers in a discussion that’s interesting, and timely, and relevant to them.”

To successfully move the dial and change the conversation around a brand, you have to be really sure what that brand stands for, Kalcher said. If you want to blend in with the rest, you’re not really a brand. So, it’s about exploring what is unique to your value proposition, where you stand out in the marketplace and how you can build on that.

“You have to be able to say, ‘this is who we are and this is why we should be your choice’,” she said. “There’s still a long way to go but, as I’ve said many times, I really would like us to be the Patagonia of insurance. I would like us to be the one that you are choosing if you’re really focused on creating a brighter future, because Zurich stands for something and is working for that agenda on a daily basis.”